Loading

Get Itr V Form 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Itr V Form online

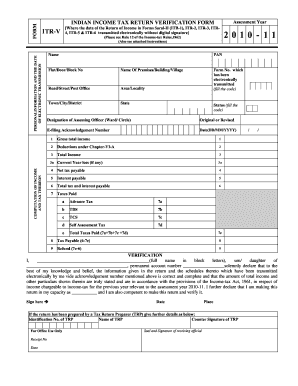

The Itr V Form is an essential document for individuals filing their income tax returns electronically in India. This guide provides clear and concise instructions to assist users in accurately completing this form online.

Follow the steps to complete the Itr V Form online:

- Press the ‘Get Form’ button to obtain the Itr V Form and open it in the editor.

- Fill in your personal information, including your name, PAN, and address details such as flat number, street name, locality, city, and state.

- Select the assessment year for which you are filing the return.

- Indicate the form number that has been electronically transmitted, using the appropriate code.

- Mark whether the form is an original or revised submission.

- Fill in your gross total income and any deductions under Chapter VI-A.

- Calculate your total income by subtracting deductions from gross total income.

- Provide details of any current year loss that may apply.

- Calculate your net tax payable and interest if applicable, then sum them to get the total tax and interest payable.

- Enter any taxes that have been paid, including advance tax, TDS, TCS, and self-assessment tax.

- Sum up the total taxes paid and deduct it from the total tax and interest payable to determine if there is any tax payable or refund.

- In the verification section, write your name in block letters, declare the correctness of the information provided, and include your designation.

- Sign the form, date it, and indicate your place of signing.

- If applicable, provide details of the Tax Return Preparer, including their name, counter signature, and identification number.

- Once you have completed the form, you may save changes, download, print, or share the document as needed.

Complete your Itr V Form online today to ensure compliance with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You should indicate the share of profit from a partnership firm in the income from business or profession section of the ITR V Form. It’s vital to ensure that this income is reported accurately to avoid discrepancies. Proper representation within the ITR ensures that you meet your tax obligations. Understanding where to place this information simplifies your filing process significantly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.