Get Sa330 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa330 online

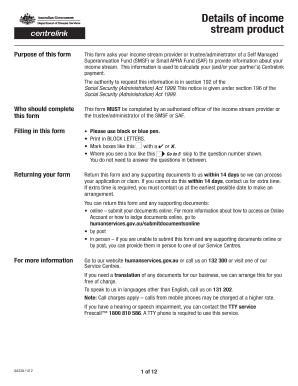

Filling out the Sa330 online is a crucial step for income stream providers, trustees, or administrators of self-managed superannuation funds. This guide aims to walk you through each section of the form to ensure you provide the necessary information accurately.

Follow the steps to guide you through the completion of the Sa330 form.

- Click the ‘Get Form’ button to access the Sa330 form and open it in your preferred editor.

- Begin by entering the required details in the provided fields, ensuring to use a black or blue pen and print in block letters.

- Indicate whether there is a joint owner for the income stream. If yes, provide details for Customer 2 including family name, date of birth, and share percentage.

- Fill in the provider details section, including name, Australian Business Number (ABN), and postal address if applicable.

- Respond to questions regarding the nature of the income stream, including whether it was purchased with superannuation funds, and the type of income stream product.

- For income stream products classified as account-based, calculate the gross annual payment, ensuring it reflects the expected amounts for the financial year.

- Complete the section that requires you to provide information on any commutations that have occurred since the income stream commenced.

- Review the checklist provided at the end of the form to confirm that all necessary conditions for the income stream are met.

- Once all information is completed, ensure every field is accurately filled. Save any changes made, download a copy for your reference, and print the form if required.

- After completing the form, you can submit it online, return it by post, or deliver it in person to a service center with any supporting documents within the stipulated timeframe.

Complete your Sa330 form online today to facilitate your income stream assessment.

A CSS pension is not exactly an account-based income stream; rather, it represents a defined benefit scheme. Under this system, retirees receive a predetermined amount based on their salary and years of service. This type of pension can be an appealing option for those interested in consistent income without having to navigate numerous investments or the paperwork that often accompanies forms like the SA330.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.