Loading

Get Printable Mileage Log 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Printable Mileage Log online

This guide provides users with step-by-step instructions on how to effectively fill out the Printable Mileage Log online. Whether you are an experienced user or new to digital document management, this comprehensive guide is designed to help you navigate each section with confidence.

Follow the steps to complete the Printable Mileage Log.

- Click 'Get Form' button to obtain the form and open it in the editor.

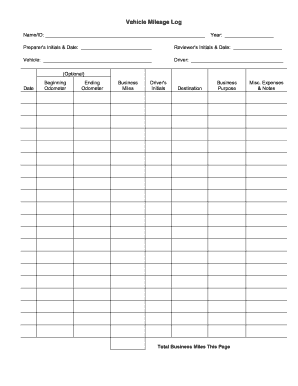

- Begin by filling in your name or ID at the top of the form. This helps to identify the individual completing the log.

- Enter the year for which you are logging the mileage. This is important for record-keeping purposes.

- In the section for preparer's initials, indicate your initials along with the date you are completing the form. This provides a record of who prepared the log.

- If applicable, have a reviewer initial and date the form in the corresponding fields. This is an optional step but adds an extra layer of verification.

- Record the vehicle used for business in the designated field. This identifies which vehicle's mileage is being logged.

- Fill in the name of the driver, ensuring that this reflects who operated the vehicle for the recorded trips.

- For each trip, document the date, beginning odometer reading, and ending odometer reading accurately. This will allow for precise calculation of mileage.

- Specify the business miles traveled for each trip by entering this figure in the appropriate column.

- In the driver's initials section, confirm by entering the initials of the driver for accountability.

- Document the destination and business purpose for each trip to provide context for the mileage logged.

- Sum the total business miles for that page and record it in the designated field to keep track of overall mileage.

- If there are miscellaneous expenses or notes related to the trips, list them in the provided section for clarity and record-keeping.

- Once you have completed the form, proceed to save your changes. You can then download, print, or share the completed log as needed.

Start filling out your Printable Mileage Log online today for easy tracking and management of your mileage records.

Calculating your mileage for taxes involves summing up all the miles driven for business, as recorded in your Printable Mileage Log. Apply the IRS standard mileage rate to determine the deduction you can claim. Staying accurate with your log will make this process seamless and effective.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.