Loading

Get Nh Dp 10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nh Dp 10 online

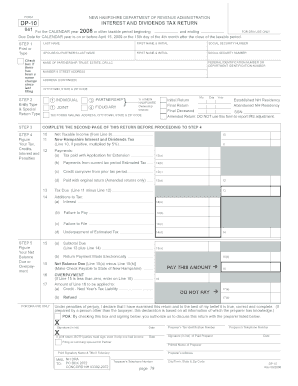

Filling out the Nh Dp 10 form for the Interest and Dividends Tax Return may seem daunting, but with clear guidance, you can complete it efficiently. This guide provides step-by-step instructions tailored to support all users, regardless of their familiarity with tax forms.

Follow the steps to complete the Nh Dp 10 form online.

- Press the ‘Get Form’ button to access the Nh Dp 10 form and open it for editing.

- Enter your personal information, including your last name, first name and initial, social security number, and address details. If applicable, fill in your spouse or civil union partner's information as well.

- Select the entity type that best describes your filing status. Options include Individual, Joint, Partnership, Fiduciary, and more. Indicate if this is your initial return or if you are establishing or abandoning New Hampshire residency.

- Navigate to the second page and figure your taxable income based on your federal income tax return. Input the totals for interest and dividends as required by the form.

- Calculate any adjustments for your net taxable income, including any state exemptions you qualify for. Enter these totals in the designated fields.

- Determine your tax liability by calculating the New Hampshire Interest and Dividends Tax based on your net taxable income.

- If applicable, report any payments you've already made towards this tax period. Subtract these payments from your total tax calculated to determine any balance due.

- Complete the final section by signing and dating the form in blue or black ink. Ensure all sections are filled before proceeding to save, download, or print your completed tax return.

Start completing your Nh Dp 10 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

INDIVIDUALS: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.