Loading

Get Downloadable W 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Downloadable W 9 Form online

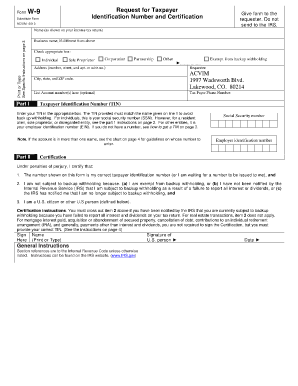

Completing the Downloadable W 9 Form is an essential process for individuals and businesses who need to provide their taxpayer identification information. This guide will walk you through each section of the form, ensuring you understand what is required and how to fill it out accurately.

Follow the steps to fill out your W 9 Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter your name as shown on your income tax return. If you operate under a business name, list it in the designated field. Below this, check the appropriate box that describes your status—options include individual, sole proprietor, corporation, partnership, or other.

- Fill in your address, including the number, street, apartment, or suite number. Continue with your city, state, and ZIP code.

- If applicable, enter any account number(s) in the space provided; this section is optional.

- Provide your taxpayer phone number for direct communication regarding the information submitted.

- In the next section, enter your Taxpayer Identification Number (TIN). For most individuals, this will be your Social Security number (SSN). For other entities, use your Employer Identification Number (EIN). Make sure the TIN corresponds correctly with the name provided in Part I.

- If you are exempt from backup withholding, check the corresponding box. Read the certification statements carefully. By signing, you confirm that the TIN provided is correct and that you are not subject to backup withholding.

- Sign and date the form where indicated. Ensure your name is printed clearly, and do not forget to date the form to validate your submission.

- Once you have completed all sections of the form, you can save your changes, download a copy for your records, or print it out. Share the completed form with the requester; do not send it directly to the IRS.

Complete your W 9 Form online today for a smooth documentation process.

To request W9 information, you must send the form to the individual or entity that has provided a service to your company. You can download the form, free, from the IRS's website. You could also create your own form, but it must contain the same information as the official IRS document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.