Loading

Get Sbi Withdrawal Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sbi Withdrawal Form online

Filling out the Sbi Withdrawal Form online can be a straightforward process. This guide provides step-by-step instructions to ensure users complete the form accurately and efficiently.

Follow the steps to successfully complete the Sbi Withdrawal Form online.

- Click 'Get Form' button to obtain the form and access it for editing.

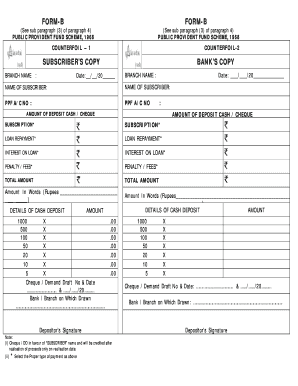

- Enter the branch name in the designated field for both the subscriber and bank copies. This ensures the form is connected to the correct banking branch.

- Fill in the date of the transaction by selecting or typing the date in the appropriate format.

- Provide the name of the subscriber in the name field. This is required to identify the person making the withdrawal.

- Enter the PPF account number in the specified section to link the withdrawal to the proper account.

- Indicate the amount of deposit by selecting the type of payment, whether cash or cheque, and fill in the respective fields for subscriptions, loan repayments, interest on loan, and any penalties or fees.

- Calculate the total amount and enter it in the total amount field. Additionally, write the amount in words in the designated area.

- Detail the cash deposit amounts in the specified breakdown fields, indicating the quantity for each denomination.

- If applicable, enter the cheque or demand draft number along with the date, and specify the bank or branch on which it is drawn.

- Complete the process by ensuring the depositor’s signature is provided at the end of the form.

- Once all details are filled accurately, save the changes, download the form, print it, or share it as needed.

Complete your Sbi Withdrawal Form online today for a hassle-free experience.

Yes, SBI has introduced modifications to its ATM transaction rules for 2025 to align with modern banking practices. These changes focus on increased transaction limits and enhanced security measures for users. By familiarizing yourself with these updates, you can effectively utilize the Sbi Withdrawal Form to ensure smooth transactions in the upcoming year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.