Loading

Get 2014 Newark Payroll Tax Statement - 3rd Quarter - The City Of ... - Ci Newark Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Newark Payroll Tax Statement - 3rd Quarter - The City Of Newark online

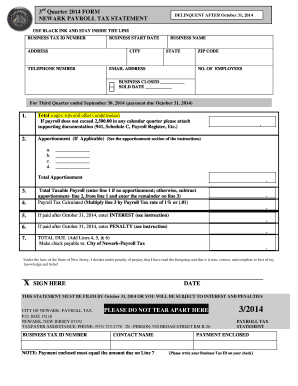

This guide provides step-by-step instructions for filling out the 2014 Newark Payroll Tax Statement for the 3rd quarter. Completing this form online ensures accurate reporting of your payroll taxes to the City of Newark.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your business tax ID number in the designated field. This number is essential for identifying your business in the system.

- Enter your business name, along with your address, city, state, and ZIP code. Ensure all information is accurate and updated.

- Fill in the business start date and the telephone number where you can be reached.

- If applicable, indicate if your business is closed or sold and provide the relevant dates.

- Report the total wages, tips, and other compensation paid during the third quarter. If your payroll does not exceed $2,500 in any calendar quarter, attach necessary supporting documentation, such as Form 941, Schedule C, or your payroll register.

- Calculate apportionment if it's applicable by completing the appropriate sections provided on the form. If you have no apportionment, proceed to the next step.

- Determine the total taxable payroll. If there is no apportionment, enter the total wages from step 6. If there is apportionment, subtract the apportionment total from the total wages.

- Calculate the payroll tax by multiplying the total taxable payroll by the payroll tax rate of 1% (or 0.01). Enter this amount in the designated field.

- If your payment is submitted after October 31, 2014, calculate and enter any interest accrued as instructed.

- Calculate and enter any penalties incurred for late payment, as directed.

- Add the amounts from steps 9, 10, and 11 to arrive at the total due. Make sure this amount lines up with your calculations.

- Sign and date the form at the bottom, confirming that the information provided is true and correct.

- Once you have completed the form, you can save your changes, download it, print it, or share it as necessary.

Complete your 2014 Newark Payroll Tax Statement online today to ensure compliance and avoid penalties.

The Newark payroll tax rate is 1% of wages for services performed within Newark, for services supervised from Newark and for wages of employees who principally report to a location in Newark. If the total wages are less than $2,500, no tax is due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.