Loading

Get Form 12009 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12009 online

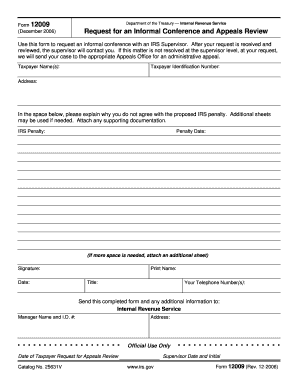

This guide provides step-by-step instructions on how to fill out the Form 12009 online. Whether you are requesting an informal conference with an IRS Supervisor or seeking an appeals review, this comprehensive overview will help simplify the process.

Follow the steps to complete your Form 12009 with ease.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Taxpayer Name(s)' field, enter the names of all individuals or entities involved in the case.

- Input the 'Taxpayer Identification Number' in the specified field. This may include your Social Security Number or Employer Identification Number.

- Provide your current 'Address.' Ensure that it is accurate to facilitate communication.

- In the provided space, explain the reasons for your disagreement with the proposed IRS penalty. If necessary, attach additional sheets with your explanation.

- Fill in the 'IRS Penalty' field with the specific penalty you are contesting.

- Record the 'Penalty Date' to indicate when the penalty was issued.

- Sign and date the form in the appropriate fields to validate your request. Also, provide your printed name and title, if applicable.

- Enter your telephone number(s) to ensure the IRS can easily reach you for follow-up.

- Send this completed form along with any additional documentation to the designated IRS address mentioned in the form.

- After satisfying all the requirements, save your changes, download, print, or share the form as needed.

Begin the process of completing your Form 12009 online today.

To send a letter to the IRS, ensure your correspondence includes all necessary information, such as your taxpayer identification number and the tax year involved. You can send your letter via certified mail for proof of delivery. Do not forget to use Form 12009 if your letter relates to an appeal to ensure it is processed appropriately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.