Get W19 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W19 Form online

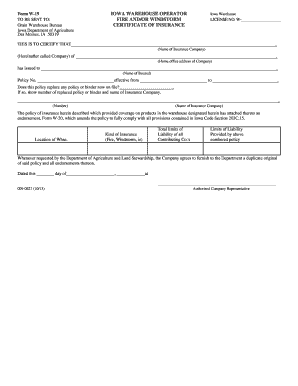

Filling out the W19 Form online is a straightforward process that involves providing detailed information about insurance coverage for warehouse operators in Iowa. This guide will walk you through each section of the form to ensure a smooth and accurate submission.

Follow the steps to complete the W19 Form online effectively

- Click 'Get Form' button to obtain the form and open it in the program.

- Begin by entering the Iowa Warehouse License Number in the designated field.

- In the section labeled 'This is to certify that,' fill in the name of the insurance company and its home office address.

- Next, enter the name of the insured individual or entity in the corresponding space.

- Provide the insurance policy number and the effective dates of the policy, including both start and end dates.

- If applicable, indicate whether this policy replaces any previous policy or binder and include the number of the replaced policy and the name of the insurance company.

- Complete the section regarding the location of the warehouse and the total limits of liability for all contributing companies.

- Specify the kind of insurance (e.g., fire, windstorm) and the limits of liability provided by the mentioned policy.

- Ensure that you review the commitment of the company to provide a duplicate original of the policy upon request by the Department of Agriculture and Land Stewardship.

- Finally, date the form and include the signature of the authorized company representative before saving your changes, downloading, printing, or sharing the form.

Start completing your documents online today for a hassle-free experience.

Individuals who receive payments as independent contractors or freelancers typically fill out a W9 form. This includes anyone in a position where they must provide their taxpayer identification information to a business. By completing the W9, you are aiding in proper tax reporting and compliance. If you need assistance with your form, consider exploring resources like US Legal Forms for accurate information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.