Loading

Get Form 132 - Icpr - Forms.in.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 132 - ICPR - Forms.IN.gov online

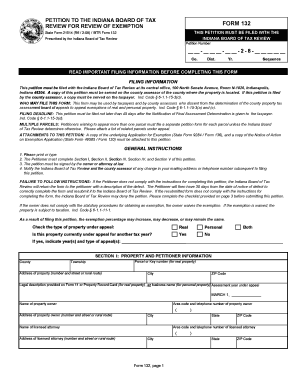

This guide provides clear and comprehensive instructions on completing the FORM 132, a petition for review of exemption with the Indiana Board of Tax Review. Whether you are a taxpayer or a county assessor, this resource will assist you in every aspect of filling out the form correctly and efficiently.

Follow the steps to complete the FORM 132 online.

- Press the ‘Get Form’ button to access the online version of the form, allowing you to easily fill it out in the designated editor.

- Begin by completing the petition number, county, district, year, and sequence fields in the header section of the form. Make sure to check the filing information provided before proceeding.

- In Section I, enter the property and petitioner information. Fill in the address of the property, parcel or key number, name and address of the property owner, and the name and contact information of the licensed attorney if applicable.

- Section II requires you to detail the actions taken by the county property tax assessment board of appeals. Enter the assessment determination along with the percentages for exemption and taxable values.

- In Section III, select the specific statute under which the exemption is claimed by checking the appropriate box. Provide a detailed explanation for your belief that the county board's action is incorrect, citing applicable laws or regulations.

- Section IV is for signatures. Both the property owner and the attorney representative must certify their information is accurate. Ensure that both parties sign and date the form.

- In Section V, confirm the certificate of service by affirming that a copy of this petition has been served on relevant parties. Sign and date this section as well.

- Review the checklist at the end of the form. Ensure all required documents are attached, including the Notice of Action on Exemption Application and the Application for Exemption.

- Finally, save your changes, download a copy, print the document, or share it as required. Ensure that you follow all filing deadlines and instructions before submission.

Complete your FORM 132 online today to ensure your petition is properly filed and your rights are protected.

Indiana property tax caps limit the amount of property taxes to 1% of property values for homesteads (owner-occupied), 2% for other residential property and farmland, and 3% for all other property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.