Loading

Get Option To Purchase

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Option To Purchase online

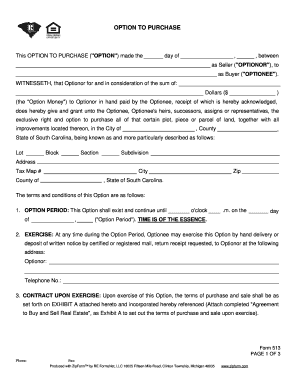

Filling out the Option To Purchase document is an important step in securing the right to buy property. This guide will walk you through each section of the form, helping you complete it accurately and confidently.

Follow the steps to fill out the Option To Purchase.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date at the top of the form where indicated. This date marks the official start of the Option agreement.

- In the 'Seller/Optionor' section, input the full legal name of the seller, followed by the name of the buyer in the 'Buyer/Optionee' section. Ensure correct spelling for clarity.

- Specify the amount of Option Money in words and numbers in the designated field. This is the payment that allows the buyer the exclusive right to purchase the property.

- Provide the detailed property description, including the lot number, block, section, subdivision, and the full address. Be as precise as possible to avoid any legal disputes.

- Indicate the Option Period by filling in the date and time when this option will expire. Time is crucial, so double-check these details for accuracy.

- Fill out the exercise clause, which outlines how the buyer can exercise the option. Include the delivery method for the notification to the seller.

- Attach any additional documents referenced, such as the 'Agreement to Buy and Sell Real Estate' as Exhibit A, ensuring all necessary information is complete and accurate.

- Review the terms about the application of Option Money. Clarify whether it will be applied to the purchase price or retained by the seller if the option is not exercised.

- Finally, sign the document where indicated and include the signatures of witnesses if required. Confirm that all parties involved have completed their signatures, using 'they' as a neutral pronoun.

- After completing the form, save your changes, then download, print, or share the document as needed.

Take the first step in securing your property by completing the Option To Purchase online.

A right of first refusal (ROFR) and a right of first negotiation (Rofn) are often confused, but they serve different purposes. An ROFR grants the right to buy before the property is sold to another party, while a Rofn allows the holder to negotiate before the owner offers the property to others. Understanding these distinctions helps you make informed decisions about your investment options regarding purchasing property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.