Loading

Get St 108 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-108 online

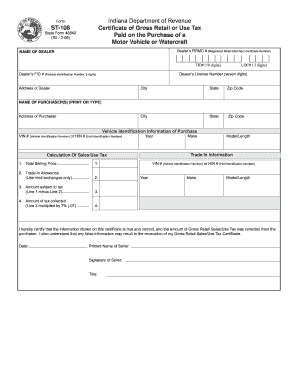

The ST-108 form is essential for certifying the payment of gross retail or use tax on the purchase of a motor vehicle or watercraft in Indiana. This guide provides a clear, step-by-step approach to assist users in completing this form online with confidence.

Follow the steps to complete your ST-108 form accurately online.

- Click the ‘Get Form’ button to access the ST-108 online. This will open the form in your browser, ready for you to fill it out.

- Begin by entering the dealer's information: name, address, dealer's license number, and the 10-digit Registered Retail Merchant Certificate Number (RRMC) along with the 3-digit location number (LOC). Ensure all details match what is on the dealer's certification.

- Next, provide the purchaser's information by typing their name and address accurately in the designated fields.

- For the vehicle or watercraft, enter the Vehicle Identification Number (VIN) or Hull Identification Number (HIN), year of manufacture, and model name or length, as appropriate.

- Calculate the sales/use tax by first entering the total selling price in Line 1. Include all relevant costs that lead to the final price, excluding federal excise tax.

- If applicable, indicate the trade-in allowance for like-kind exchanges only in Line 2. Fill in the relevant information for the trade-in vehicle or watercraft, including its make, model, year, and identification number.

- On Line 3, compute the amount subject to tax by subtracting Line 2 from Line 1. This amount is what the sales/use tax will be based on.

- Calculate the amount of tax collected on Line 4 by multiplying Line 3 by 7% (0.07). This is the tax amount that the seller collects from the purchaser.

- Finally, read the certification statement carefully. The seller must type their printed name, sign the form, and include their title to verify that the information is accurate and that they will forward the tax collected to the Department of Revenue.

- Once all fields are filled out correctly, save your changes. You can also download, print, or share the completed ST-108 form as needed.

Complete your ST-108 form online today to ensure accurate tax certification for your vehicle or watercraft purchase.

To obtain your NP-1 form online in Indiana, you can visit the Indiana Department of Revenue's official site. Navigating their forms section will direct you to download and print the NP-1. Make sure to review your form thoroughly before submission. The ST-108 form may assist you with verifying tax-exempt purchases related to your non-profit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.