Loading

Get Irs Substitute W-9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Substitute W-9 Form online

Filling out the IRS Substitute W-9 Form online is an essential task for individuals and entities that need to provide their taxpayer identification information for reporting purposes. This guide will walk you through each step to ensure accurate completion of the form.

Follow the steps to complete the IRS Substitute W-9 Form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

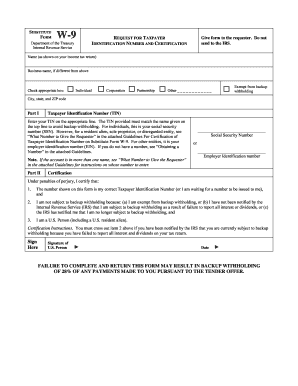

- Enter your name exactly as it appears on your income tax return in the designated field.

- If your business name differs from your personal name, input it in the provided space.

- Select the correct box that applies to your status: Individual, Corporation, Partnership, Exempt from backup withholding, or Other.

- Fill in your city, state, and ZIP code in the appropriate fields.

- In Part I, enter your Taxpayer Identification Number (TIN). For individuals, this is your Social Security Number (SSN). If you are a resident alien or sole proprietor, ensure the correct number is entered.

- In Part II, based on your situation, provide your Social Security Number or Employer Identification Number as needed.

- Read and certify the statements under Certification. Make sure all information is accurate. If applicable, cross out item 2 if you have been notified by the IRS regarding backup withholding.

- Sign the form by providing your signature and the date, confirming that the information provided is correct.

- Once completed, save your changes and choose to download, print, or share the form as necessary.

Complete your IRS Substitute W-9 Form online today to ensure compliance and accuracy.

A suitable substitute for a W9 is the IRS Substitute W-9 Form, which can be used when the standard version cannot be sourced. This alternative maintains your ability to provide taxpayer identification and ensures compliance with tax regulations. Utilizing platforms like USLegalForms allows you to access these forms conveniently and quickly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.