Loading

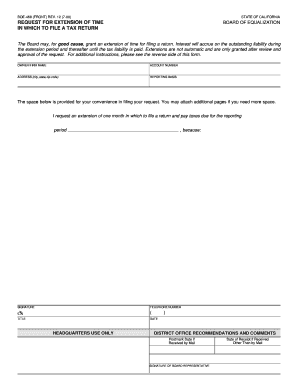

Get California Boe-468, Request For Extension Of Time To File, Rev. 12

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California Boe-468, Request For Extension Of Time To File, Rev. 12 online

Filing taxes can be a complex process, and sometimes, additional time is needed to complete your return. The California Boe-468 is a crucial form that allows taxpayers to request an extension for filing their tax returns. This guide provides clear, step-by-step instructions for filling out this form online.

Follow the steps to complete your extension request effectively.

- Press the ‘Get Form’ button to access the Boe-468 form and open it in your preferred online editor.

- Begin by entering your owner or firm name in the designated field. This should match the name associated with your tax account.

- Input your account number as assigned by the Board of Equalization. This helps to identify your tax records.

- Fill in your address, including city, state, and zip code. Ensure this information is accurate and up to date.

- Indicate your reporting basis in the corresponding section to clarify the type of tax return you are requesting an extension for.

- In the provided space, state your request for an extension period. Specify that you are requesting an extension of one month for the reporting period mentioned.

- Clearly explain your reason for needing an extension in the space provided. This explanation is essential for the review process.

- Sign the form to authenticate your request. This signature is necessary to validate your application for an extension.

- Next, enter your telephone number to ensure that the Board can reach you if there are any questions regarding your request.

- Include your title in the appropriate space, if applicable, to provide context regarding your authority to submit the request.

- Insert the date when you are submitting the form to establish a timeline for your request.

- Once the form is completed, review all entries for accuracy, then save your changes. You can download or print the form for your records or share it based on your needs.

Take the next step and fill out the California Boe-468 online to request your tax filing extension today.

California Personal income tax and corporate tax filing and payment deadlines postponed to July 15, 2020. This includes 2020 1st and 2nd quarter estimated tax payments. LLC taxes and fees and non-wage withholding filing and payments deadline extended to July 15, 2020. Interest and penalties will be waived.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.