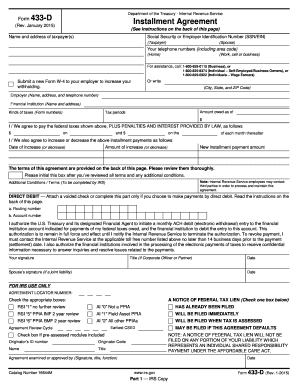

Get Form 433-d (rev. 1-2015). Installment Agreement - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Form 433-D (Rev. 1-2015). Installment Agreement - Irs online

How to fill out and sign Form 433-D (Rev. 1-2015). Installment Agreement - Irs online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Legal, taxation, corporate as well as other electronic documents necessitate a heightened level of adherence to the regulations and safeguarding.

Our forms are consistently refreshed in line with the most recent changes in the regulations.

Our platform enables you to complete all legal documents online. Consequently, you can save hours (if not days or even weeks) and eliminate unnecessary expenses. From this point on, file Form 433-D (Rev. 1-2015). Installment Agreement - Irs from the convenience of your residence, business premises, or even while you are traveling.

- Access the document in the comprehensive online editing application by clicking on Get form.

- Fill in the required sections that are highlighted in yellow.

- Press the arrow labeled Next to move from one field to the next.

- Navigate to the electronic signature option to append an e-signature to the document.

- Enter the pertinent date.

- Re-examine the entire document to ensure nothing significant has been overlooked.

- Click Done and save your new document.

Ways to Revise Get Form 433-D (Rev. 1-2015). Installment Agreement - IRS: Personalize documents online

Bid farewell to a conventional paper-based approach to processing Get Form 433-D (Rev. 1-2015). Installment Agreement - IRS. Accomplish the document swiftly and efficiently with our expert online editor.

Are you struggling to alter and finalize Get Form 433-D (Rev. 1-2015). Installment Agreement - IRS? With a powerful editor like ours, you can finish this in mere minutes without the necessity to print and scan forms repeatedly. We provide fully customizable and user-friendly document templates that will act as a foundation and assist you in completing the required form online.

All forms, by default, come equipped with fillable fields you can execute once you open the template. However, if you need to enhance the existing content of the document or add new content, you can choose from a variety of editing and annotation options. Emphasize, obscure, and comment on the text; incorporate checkmarks, lines, text boxes, images, notes, and remarks. Furthermore, you can easily validate the template with a legally-binding signature. The finalized document can be shared with others, stored, sent to external programs, or converted into any widely-used format.

You won’t regret utilizing our web-based tool to process Get Form 433-D (Rev. 1-2015). Installment Agreement - IRS because it is:

Don't squander time modifying your Get Form 433-D (Rev. 1-2015). Installment Agreement - IRS the traditional way - with pen and paper. Utilize our feature-rich alternative instead. It provides you with a comprehensive suite of editing options, built-in eSignature functionalities, and user-friendliness. What makes it exceptional is its team collaboration features - you can collaborate on forms with anyone, develop a structured document approval workflow from scratch, and much more. Experiment with our online tool and achieve excellent value for your investment!

- Simple to establish and utilize, even for those who haven’t filled the documents online previously.

- Robust enough to accommodate various modification needs and document types.

- Safe and secure, ensuring your editing experience is protected each time.

- Accessible on multiple devices, making it easy to finish the document from anywhere.

- Able to create forms based on pre-existing templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT, and JPEG etc.

To get out of an IRS installment agreement, you will need to formally request termination, which can be done through written communication. You may also consider paying off the total amount due in a lump sum. It’s essential to consult with a tax professional to discuss the best options tailored to your financial situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.