Loading

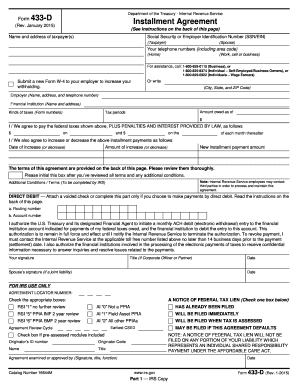

Get Form 433-d (rev. 1-2015). Installment Agreement - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 433-D (Rev. 1-2015). Installment Agreement - IRS online

Filling out the Form 433-D is an essential step for individuals or businesses entering into an installment agreement with the IRS. This guide provides clear, detailed instructions to help users navigate the form efficiently and accurately.

Follow the steps to fill out your IRS installment agreement form.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Enter the name and address of the taxpayer(s) in the designated fields. Make sure to include both the primary taxpayer and spouse when applicable.

- Provide the Social Security or Employer Identification Number (SSN/EIN) for both the taxpayer and the spouse in the specified sections.

- Fill in your telephone numbers, including area code, in the provided fields for home and work, cell, or business contacts.

- Complete the fields related to your employer, including their name, address, and telephone number.

- Identify your financial institution by providing its name and address.

- Specify the total amount owed as of the date mentioned on the form, and detail the tax periods and types of taxes involved.

- Agree to pay the stated federal taxes, including penalties and interest, by entering the amounts and payment schedule in the designated boxes.

- Indicate any adjustments to your installment payments by entering the date and new payment amounts if applicable.

- Review all terms of the agreement as listed on the back of the form and initial the box to confirm that you understand them.

- If choosing direct debit, attach a voided check or complete the routing and account number sections accurately.

- Sign and date the form, and if applicable, have your spouse also sign and date it.

- After completing all sections of the form, return it to the IRS at the specified address.

Complete your IRS installation agreement form online to ensure accurate and timely submissions.

To get out of an IRS installment agreement, you will need to formally request termination, which can be done through written communication. You may also consider paying off the total amount due in a lump sum. It’s essential to consult with a tax professional to discuss the best options tailored to your financial situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.