Get Ct 3911

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Ct 3911 online

How to fill out and sign Ct 3911 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Drafting legal papers can be costly and labor-intensive. Nevertheless, with our ready-made online templates, the process becomes easier.

Now, utilizing a Ct 3911 requires no more than 5 minutes.

Submit immediately to the intended recipient. Utilize the fast search and robust cloud editor to compose a precise Ct 3911. Eliminate the monotony and generate documents online!

- Choose the online template from the library.

- Fill in all mandatory details in the specified fields.

- The user-friendly drag-and-drop interface allows for easy addition or movement of fields.

- Ensure all information is correctly filled out, with no errors or empty sections.

- Add your digital signature to the document.

- Simply click Done to save your changes.

- Download the file or print your PDF copy.

How to modify Get Ct 3911: tailor forms online

Equip yourself with effective document management functionalities. Complete Get Ct 3911 with our dependable solution that includes editing and eSignature features.

If you wish to execute and validate Get Ct 3911 online effortlessly, then our cloud-based option is the perfect solution. We provide a comprehensive library of template-based forms that you can edit and complete online. Moreover, there is no need to print the document or rely on external options to make it fillable. All necessary tools will be at your disposal as soon as you access the document in the editor.

Let's explore our online editing functionalities and their primary features. The editor has an intuitive interface, so it won’t require much time to master it. We’ll examine three key components that allow you to:

In addition to the aforementioned capabilities, you can protect your document with a password, add a watermark, convert the document to the desired format, and much more.

Our editor simplifies the process of completing and certifying Get Ct 3911. It allows you to practically do everything related to document handling. Furthermore, we consistently ensure that your document interaction experience is secure and compliant with major regulatory standards. All these aspects enhance the enjoyment of utilizing our solution.

Obtain Get Ct 3911, make the necessary modifications and adjustments, and receive it in your preferred file format. Give it a try today!

- Edit and comment on the template

- The upper toolbar consists of tools that assist you in highlighting and redacting text, excluding images and visual elements (lines, arrows, checkmarks, etc.), adding your signature, initializing, dating the form, and more.

- Organize your documents

- Utilize the left toolbar if you wish to rearrange the form or remove pages.

- Ensure they are shareable

- If you want to make the template fillable for others and share it, you can use the tools on the right to insert various fillable fields, signatures, dates, text boxes, etc.

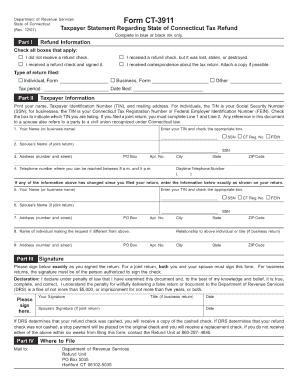

To file the CT-3911, start by gathering all necessary information regarding your tax situation. Download the form from the US Legal Forms platform, fill it out accurately, and submit it as per the instructions provided. You can file it online for convenience or send it via mail. Ensure you keep a copy for your records, as it is important documentation in your tax dealings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.