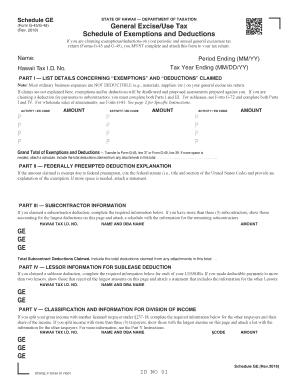

Get Schedule Ge, Form G-45/g-49, Rev 2018, General Excise/use Tax Schedule Of Exemptions And Deductions. Forms 2018 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule GE, Form G-45/G-49, Rev 2018, General Excise/Use Tax Schedule of Exemptions and Deductions online

Filling out the Schedule GE, Form G-45/G-49, is essential for claiming exemptions and deductions on your general excise/use tax return. This guide provides a detailed walkthrough of each section, ensuring you understand how to complete the form accurately.

Follow the steps to complete the Schedule GE form online.

- Select the ‘Get Form’ button to access the form and open it for editing.

- Enter your name, period ending (MM/YY), and tax year ending (MM/DD/YY) at the top of the form. Also, provide your Hawaii Tax I.D. number.

- In Part I, list the details of the exemptions and deductions you are claiming. Enter the corresponding Activity and ED code related to each exemption or deduction, along with the amount for each.

- Ensure to provide an explanation for each exemption or deduction claimed. If these details are insufficient, your claims may be disallowed.

- If you are claiming exemptions due to federal preemption, complete Part II by citing the federal statute and providing a brief explanation.

- For subcontractor deductions, complete Part III with the details of your subcontractors. If applicable, provide information for the largest deductions and attach a schedule for additional subcontractors.

- If applicable, complete Part IV with the required information about the lessors for any sublease deductions claimed.

- In Part V, if you have split your income with other taxable entities, provide the necessary information for each entity involved.

- Review all the entries for accuracy and completeness. Once finalized, save your changes, and choose to download, print, or share the form as needed.

Complete your Schedule GE form online today to ensure your exemptions and deductions are properly claimed.

Sales tax and general excise tax differ fundamentally in their application. While sales tax is charged at the point of sale directly to consumers, the general excise tax is applied to businesses on their gross income. Understanding the implications of Schedule GE, Form G-45/G-49, Rev 2018, General Excise/Use Tax Schedule Of Exemptions And Deductions allows businesses to navigate Hawaii's tax system effectively. For a clearer understanding, uslegalforms offers excellent resources to guide you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.