Loading

Get Rev 638 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 638 Form online

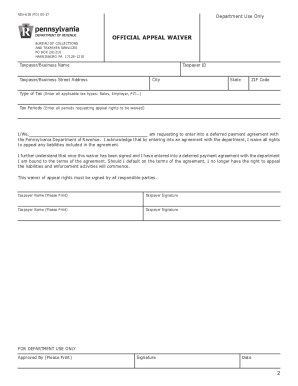

Filling out the Rev 638 Form online can simplify the process of initiating a Deferred Payment Plan with the Pennsylvania Department of Revenue. This comprehensive guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Rev 638 Form online.

- Click ‘Get Form’ button to obtain the Rev 638 Form and open it in your preferred online editor.

- Begin by entering the date on the designated line at the top of the form, clearly marking when you are submitting the request.

- In the address section, input the Pennsylvania Department of Revenue address as outlined: PO Box 281210, Harrisburg PA 17128-1210.

- In the designated area, indicate whether you wish to waive your appeal rights for the relevant tax year(s). Ensure you specify the tax year(s) accurately.

- State your understanding of the implications of waiving your appeal rights as clearly outlined in the form. It is essential to acknowledge that doing so is necessary to set up the payment agreement.

- If applicable, provide the names and signatures of both primary and secondary taxpayers. Remember, signatures must be provided after printing.

- Include each taxpayer's Social Security Number in the designated fields to ensure proper identification for processing.

- Review all entered information for completeness and accuracy to avoid any processing delays.

- Once the form is filled out, you can choose to save your changes, download a copy, print it for signatures, or share it if necessary.

Complete your forms online today to streamline your tax processes.

To fill out an employee's withholding certificate, start by entering the employee’s personal details, followed by their filing status. Calculate the number of allowances based on personal and family circumstances. For a clear and simple process, consider using the Rev 638 Form from US Legal Forms, which can assist in ensuring you complete the certificate correctly and comply with tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.