Loading

Get Texas Resale Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Resale Certificate online

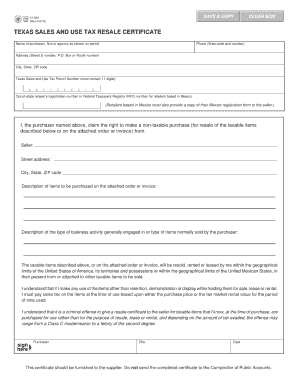

The Texas Resale Certificate is a necessary document for businesses purchasing items for resale without paying sales tax. Completing this form online can streamline the process, ensuring efficiency and accuracy in your transactions.

Follow the steps to fill out the Texas Resale Certificate online.

- Click ‘Get Form’ button to access the Texas Resale Certificate and open it in the editor.

- Enter your business's legal name in the designated field. This should reflect the name registered with your state or local government.

- Provide your business's address, including street, city, state, and zip code. Ensure that the information is current and precise.

- Input your Texas sales and use tax permit number. This number is crucial for validating your resale status.

- Specify the reason for the purchase in the appropriate section. Common reasons include business resale or inventory replenishment.

- List the description of the items being purchased tax-exempt. Be clear and specific to avoid confusion during transactions.

- Sign and date the form to confirm that the information provided is correct and that you are authorized to make purchases on behalf of the business.

- Once you have completed all sections, you can save changes, download, print, or share the form as needed.

Complete your Texas Resale Certificate online today for a smooth purchasing experience.

Related links form

Filling out an ST3 form involves providing information such as your name, address, and the items purchased for resale. Clearly indicate that these items are intended for resale and include your sales tax number. By using this form, businesses can benefit from tax exemptions when reselling products. In Texas, the Texas Resale Certificate serves a similar purpose and can be used for this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.