Loading

Get What Is Form 8879 K

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Form 8879 K online

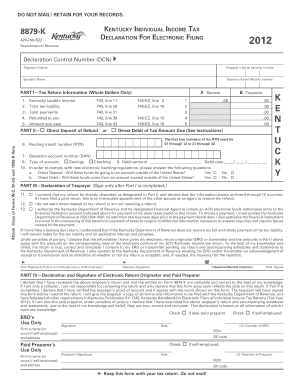

This guide provides a detailed walkthrough for filling out the What Is Form 8879 K online. Form 8879 K is essential for individuals who are electronically filing their Kentucky Individual Income Tax Return, ensuring all necessary information is correctly submitted.

Follow the steps to complete Form 8879 K online

- Click the 'Get Form' button to acquire the form and open it in your preferred online program.

- Enter the Declaration Control Number (DCN) located in the upper right corner of the form. Ensure that this number matches with both the federal electronic return and the federal Form 8879.

- Fill in the taxpayer’s name and Social Security number. Be sure to double-check the accuracy of this information.

- Next, provide the spouse’s name and Social Security number if applicable, using the same caution as with the taxpayer's information.

- In Part I, input the required data from your Kentucky tax return: taxable income, total tax liability, total payments, the amount refunded to you, and the amount you owe. Ensure you only use whole dollars.

- Proceed to Part II where you can choose direct deposit for your refund or direct debit for any tax due. Complete the necessary fields for routing transit number and depositor account number based on your bank details.

- If opting for direct debit, indicate the amount to be withdrawn and the desired debit date, ensuring it is by April 15, 2013, to meet payment deadlines.

- In Part III, carefully read and check the appropriate boxes to consent to the terms regarding your refund and direct debit, then sign the form only after ensuring all parts have been completed accurately.

- Finally, save your completed form in your records. You can download, print, or share it as needed.

Take action now to fill out your Form 8879 K online and ensure your Kentucky tax filing is compliant.

The Schedule K form is primarily used to report income and expenses for partnerships and S corporations to the IRS. It captures the financial details necessary for both the entity itself and its owners, reflecting each member's share of the profits or losses. Knowing what Form 8879 K entails can help simplify the electronic filing process associated with Schedule K.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.