Loading

Get So4 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the So4 Form online

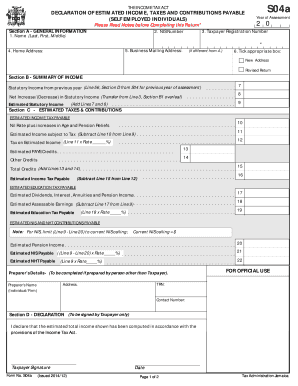

Completing the So4 Form is essential for self-employed individuals to declare estimated income, taxes, and contributions payable. This guide will help you understand each component of the form and provide clear instructions for filling it out online.

Follow the steps to effectively complete the So4 Form online:

- Press the ‘Get Form’ button to obtain the document and open it in your preferred editor.

- Enter your name (last, first, middle) in the designated field at the top of Section A.

- Provide your taxpayer registration number and National Insurance Scheme (NIS) number in their respective fields.

- Indicate the year of assessment you are completing the form for.

- Fill in your home address and business mailing address, if different.

- Check the appropriate box for whether you have a new address or are submitting a revised return.

- In Section B, report your statutory income from the previous year as indicated on Line 7.

- Provide any net increase or decrease in statutory income on Line 8 and transfer this to Line 9 to calculate estimated statutory income.

- In Section C, calculate the estimated income tax payable and enter it on Line 10.

- Complete the tax on estimated income by subtracting the estimated income subject to tax from Line 9.

- Calculate and enter any estimated PAYE credits or other credits in Lines 13 and 14 respectively.

- Total your credits in Line 15 and subtract it from Line 12 to get the estimated income tax payable.

- Proceed to estimated education tax payable in a similar manner as done for income tax.

- Enter details for estimated NIS and NHT contributions as required, ensuring to adhere to the current NIS ceiling.

- If applicable, provide preparer's details, including TRN and contact number.

- In Section D, the taxpayer must sign and date the declaration to confirm that the estimated total income is accurate.

- Once completed, save your changes, and be sure to download, print, or share the form as needed.

Start filling out the So4 Form online today to ensure your compliance with tax regulations.

You can obtain your EIN form, specifically the So4 Form, directly from the IRS website. It is available as a downloadable PDF, making it convenient to fill out and submit. For further guidance, consider checking US Legal Forms for tailored support to complete your application accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.