Loading

Get Mi W4p 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi W4p online

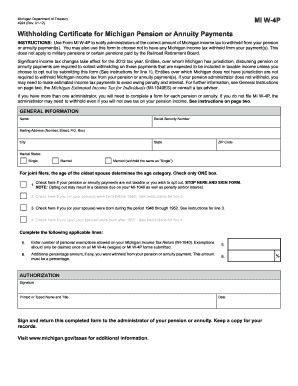

The MI W-4P form is essential for notifying administrators regarding the appropriate amount of Michigan income tax to withhold from your pension or annuity payments. This guide will provide a clear, step-by-step approach to completing the form online.

Follow the steps to successfully complete your Mi W4p form.

- Press the ‘Get Form’ button to access the MI W-4P form and open it in your preferred editor.

- Fill in your general information in the provided fields, including your name, social security number, mailing address, and city, state, and ZIP code.

- Indicate your marital status by selecting one of the options: Single, Married, or Married (withhold the same as 'Single'). Ensure to check only one box.

- Complete the line for opting out of withholding tax by checking the box on line 1 if your pension or annuity payments are not taxable. If opted out, you do not need to fill in lines 5 and 6.

- Choose the appropriate age category on lines 2 through 4 by checking the box that applies to you or your spouse based on your year of birth.

- On line 5, enter the number of personal exemptions you are allowed based on your Michigan Income Tax Return (MI-1040).

- Once all relevant information is filled out, sign and print your name and title on the authorization line along with the date.

- Return the completed form to your pension or annuity administrator. Be sure to keep a copy for your records.

Complete your MI W-4P form online to ensure proper withholding from your pension or annuity payments.

Federal tax withholding from a pension check depends on multiple factors, including your total income and the number of allowances listed on your Mi W4P. Typically, a standard withholding rate may apply, but this can vary based on individual circumstances. It’s vital to review your tax situation periodically and adjust your W4P as necessary to optimize your tax withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.