Get 1601f 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1601f online

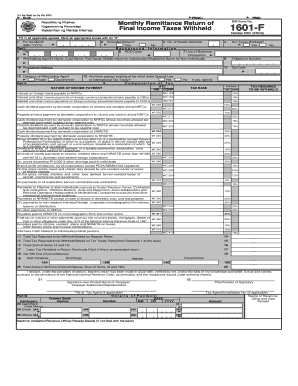

Filling out the 1601f form online is essential for individuals and organizations required to report final income taxes withheld. This guide provides detailed, user-friendly instructions to ensure accurate completion of each component of the form.

Follow the steps to fill out the 1601f form accurately.

- Click ‘Get Form’ button to obtain the form and access it in your online document editor.

- Enter the required data in the 'Background Information' section, which includes items such as the Month and Year of the filing, TIN, RDO Code, and the name of the withholder.

- Indicate if there are any taxes withheld by marking the appropriate box. Ensure that you check 'Yes' or 'No' based on actual processing.

- Complete the Section for 'Category of Withholding Agent' by selecting whether you are a private entity or a government entity, marking the correct option.

- If applicable, specify if there are any payees availing of tax relief under a Special Law or International Tax Treaty by marking the relevant box.

- In the 'Computation of Tax' section, detail the nature of income payments and calculate the tax based on the rates provided for each type of income.

- Summarize the 'Total Tax Required to be Withheld' by adding the amounts based on the regular rates and any tax treaty rates, ensuring accuracy in calculations.

- Sign and date the form in the designated area. Ensure that the printed name and title are clearly written next to the signature.

- Finally, save your changes, and download a copy of the completed form. You may also choose to print or share the document as required.

Complete your documents online efficiently and accurately for timely submission.

1601 F is a specific tax form required for reporting certain types of income by self-employed individuals and businesses. This form helps ensure compliance with tax regulations and supports accurate calculations of tax due. Filing 1601 F on time helps you avoid penalties and issues with the BIR. For assistance with understanding 1601 F, US Legal Forms offers easy-to-follow templates and resources to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.