Loading

Get W 9 Form Maine

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 9 Form Maine online

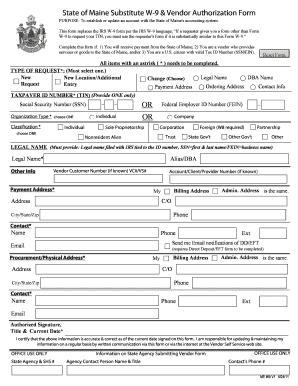

Filling out the W 9 Form Maine is an essential step for vendors seeking to establish or update their accounts with the State of Maine's accounting system. This guide will provide a clear, step-by-step approach to ensuring the form is completed accurately and efficiently.

Follow the steps to complete the W 9 Form Maine online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the type of request you are making. Choose one option from: New, Legal Name, DBA Name, or New Location/Additional Contact Info.

- Provide your Taxpayer Identification Number (TIN). You can choose to enter either your Social Security Number (SSN) or your Federal Employer Identification Number (FEIN). Ensure you provide only one.

- Next, indicate your organization type by selecting one option such as Individual, Sole Proprietorship, Corporation, or any others that apply to your situation.

- Fill in your legal name as filed with the IRS. If applicable, also enter any alias or DBA name you might have.

- Complete the contact information section including your vendor customer number if known, and provide your payment address along with your billing address.

- Input your procurement/physical address, if different from the billing address, along with contact details for this section.

- Sign the form in the designated area, provide your title, and enter the current date to certify that the information provided is accurate.

- After completing all sections, you can save your changes, download the form to your device, print it for physical copies, or share it as needed.

Complete your documents online today for a seamless filing experience.

Related links form

Yes, a W 9 Form Maine can be submitted electronically, as many clients prefer this method for convenience. You may need to send it via email or through an electronic document submission platform, depending on the requester's instructions. Electronic submission can speed up processing and ensure your information reaches the requester quickly. Just confirm with them that the electronic method is acceptable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.