Loading

Get Cra01 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cra01 online

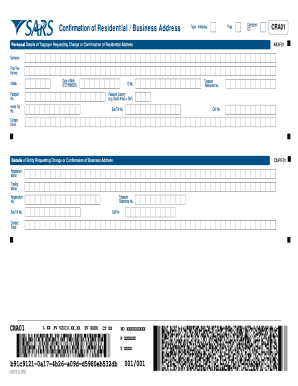

This guide provides a comprehensive overview of how to accurately fill out the Cra01 form online for confirming or changing your residential or business address. Follow these steps to ensure your submission is complete and correct.

Follow the steps to successfully complete the Cra01 form.

- Press the ‘Get Form’ button to access the Cra01 form for online completion.

- Fill in the details of the taxpayer requesting the change or confirmation of their address. Include the surname, first two names, date of birth, initials, ID number, passport number, taxpayer reference number, and the passport country code.

- Provide the taxpayer's contact information, including home telephone number, cell number, business telephone number, and contact email.

- For businesses, fill in the registered name, trading name, taxpayer reference number, registration number, cell number, business telephone number, and contact email.

- Complete the details of the person providing proof of residential address. This includes their surname, first two names, date of birth, initials, home telephone number, ID number, passport number, passport country code, relationship to the taxpayer, and contact information.

- Enter the residential address details, including the unit number, complex (if applicable), street number, street name, suburb/district, city/town, country code, and postal code.

- Ensure that the declaration is completed, confirming the truthfulness of the residential/business address and that a certified copy of the identity document or passport is attached.

- Sign the form over the indicated lines to validate your submission.

- Once all information is filled out, review the form for accuracy before saving your changes, downloading, printing, or sharing the completed Cra01.

Complete the Cra01 form online today to ensure your address is accurately recorded.

Related links form

Filing Form 8886 involves providing details about the transaction that the IRS has deemed reportable. You will need to describe the structure and context of the transaction clearly. After you complete the form, submit it to the IRS as part of your tax return. If you seek a seamless experience, uslegalforms can assist with step-by-step instructions tailored to Cra01.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.