Loading

Get Income Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Income Certificate online

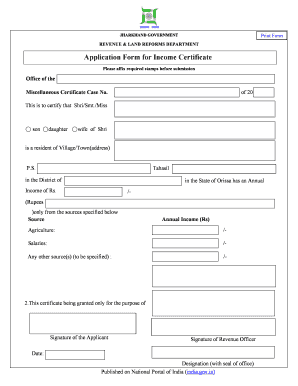

Filling out the Income Certificate is an essential step for individuals seeking to certify their annual income through an official document. This guide will provide you with clear and detailed instructions on how to complete the Income Certificate form online.

Follow the steps to complete your Income Certificate online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field, ensuring to indicate your title as Shri, Smt, or Miss, as applicable. This part identifies you as the individual applying for the certificate.

- Next, provide your relationship status, specifying whether you are the son, daughter, or partner of the individual listed in the next field. This helps establish your connection to the main applicant.

- Fill out the name of your parent or partner in the appropriate section. This creates a clear link to your family background.

- Accurately enter your complete residential address which includes your village or town, police station, tahasil, and district. This information is critical for verifying your residency.

- Indicate your annual income accurately in the respective field. You should include figures from various sources such as agriculture and salaries. Make sure to specify any additional sources of income as necessary.

- In the next section, clarify the purpose for which this certificate is being granted. This may involve stating why this income verification is needed, such as for scholarships or government assistance.

- Lastly, provide your signature and current date at the bottom of the form. There is also a field designated for the signature of the Revenue Officer and their designation, which should be completed upon submission.

- Once all fields are completed, review your form to ensure all information is accurate. You can then save changes, download, print, or share the form as required.

Start completing your Income Certificate online today!

People achieve $10,000 tax returns by maximizing eligible deductions and credits, while accurately reporting their income. An Income Certificate can provide documentation that validates their income, thus enhancing the chances for additional credits. Planning ahead and understanding tax laws greatly impact refund amounts. Seeking professional tax advice can uncover further strategies for obtaining larger returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.