Loading

Get Form 4562 Excel Template 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 4562 Excel Template online

Filling out the Form 4562 Excel Template online is a straightforward process that enables users to document their eligible tax deductions effectively. This guide provides step-by-step instructions designed to assist users, regardless of their legal experience, in completing the form accurately.

Follow the steps to successfully complete the Form 4562 Excel Template online.

- Locate and press the ‘Get Form’ button to access the Form 4562 Excel Template. This will allow you to obtain the form and view it in your preferred editor.

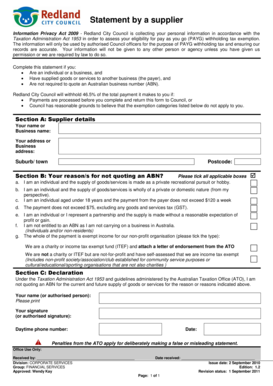

- Begin by entering your name or business name in the designated field at the top of the form.

- Next, fill in your address or business address, including the suburb or town and postal code in the respective sections.

- Proceed to Section B where you will indicate your reasons for not quoting an Australian business number (ABN) by ticking all applicable boxes. Ensure to clearly identify the reason that applies to your situation.

- In Section C, provide a declaration by printing your name or the name of an authorized person. Follow this by signing the form in the designated area.

- Include your daytime phone number and the date when you are completing the form.

- Once you have filled out all necessary fields, save your changes. You can then download, print, or share the completed Form 4562 Excel Template as needed.

Take the next step towards completing your documentation online.

To claim 100% bonus depreciation, identify the assets placed in service and ensure they qualify under IRS guidelines. Complete Form 4562 accurately, particularly the section for bonus depreciation, which reflects the allowable deduction. The Form 4562 Excel Template offered by US Legal Forms can help you track these assets efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.