Loading

Get T5 Summary Fillable 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the T5 Summary Fillable online

Filling out the T5 Summary Fillable form is essential for reporting investment income accurately. This guide will walk you through the key components and provide clear steps to ensure you complete the form correctly.

Follow the steps to successfully complete the T5 Summary Fillable form online.

- Click ‘Get Form’ button to access the T5 Summary Fillable form and open it in your designated form editor.

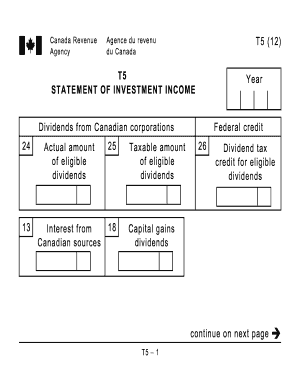

- Begin by entering the reporting year in the designated field. This indicates the tax year for which you are reporting the investment income.

- In the section for dividends from Canadian corporations, fill in the actual amount of eligible dividends in the given box. Ensure you accurately input figures to maintain compliance.

- Complete the fields regarding interest from Canadian sources. Clearly indicate the taxable amount of eligible dividends as well as the federal credit for these dividends.

- Provide details regarding capital gains dividends if applicable, ensuring accurate amounts are entered in their respective fields.

- Input the recipient’s identification number and type. This helps clarify whether the payment was made to an individual, corporation, or other entities, which is essential for accurate reporting.

- Fill in the recipient's name and address. This should include last name first, followed by the first name, with complete address details, including city, province/territory, and postal code.

- Enter the payer's name and address as you did for the recipient. Make sure the information is complete and accurate to facilitate proper processing by the Canada Revenue Agency.

- If reporting amounts in foreign currency, provide the necessary currency and identification codes. For amounts in Canadian dollars, this section can remain blank.

- Once all fields are accurately completed, review the form for errors. After ensuring all information is correct, save your changes, and proceed to download, print, or share the completed form as necessary.

Complete your T5 Summary Fillable form online today to ensure accurate reporting of your investment income.

Yes, T5 slips categorize various types of investment income, thus they count as taxable income. When you complete your T5 Summary Fillable, you summarize these amounts, which helps simplify your reporting. By accurately including T5 amounts, you maintain transparency with tax authorities and fulfill your obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.