Loading

Get Greensky Borrower Payment Authorization Certificate 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GreenSky Borrower Payment Authorization Certificate online

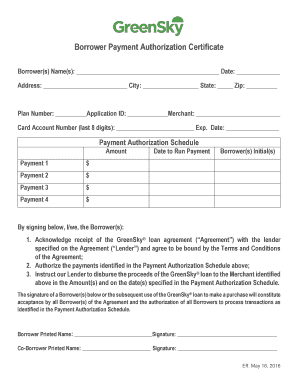

The GreenSky Borrower Payment Authorization Certificate is an important document for authorizing payment details regarding your loan. This guide will walk you through the process of filling out the form online in a clear and supportive manner.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor, where you can begin entering your information.

- In the first section labeled 'Borrower(s) Name(s)', enter the full names of all borrowers. Ensure that you include any middle names for clarity.

- Fill in the 'Date' field with the current date in the format MM/DD/YYYY. Ensure the date reflects when you are completing the form.

- Provide your borrowing address in the specified fields including 'Address', 'City', 'State', and 'Zip Code'. Verify that your address is complete and accurate.

- Next, enter your 'Plan Number' and 'Application ID'. These identifiers are usually provided in your loan documentation, so have your associated documents on hand.

- Input the 'Merchant' name for the location or service receiving the loan funds. This should be the same as mentioned in your loan agreement.

- In the 'Card Account Number (last 8 digits)' field, input the last eight digits of your card account number. This ensures accuracy in payments processed.

- Fill in the 'Exp. Date' for your card account, typically formatted as MM/YYYY to provide the expiration date.

- Under 'Payment Authorization Schedule,' enter the payment amounts for each specified payment (Payment 1 to Payment 4). Ensure that all amounts are correct and correspond to your financial plan.

- Specify the respective 'Date to Run Payment' for each payment. Make sure these dates align with your schedule for payments.

- In the section that follows, each borrower must initial to acknowledge understanding. Ensure that both parties are present to provide their initials.

- Finally, both borrower's names must be printed clearly, and signatures gathered. Ensure that all information is accurate before finalizing the document.

- Once all fields are completed, save your changes. You may download, print, or share the completed authorization certificate as necessary.

Complete your documents online for a streamlined experience.

Many borrowers find GreenSky financing accessible, especially with the GreenSky Borrower Payment Authorization Certificate in hand. Approval often hinges on your credit history and financial situation. However, the process is designed to be user-friendly, making it easier for you to get the help you need. If you feel uncertain, consider using platforms like US Legal Forms to navigate your options more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.