Loading

Get Ny Nyl Ann43042f 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY NYL ANN43042F online

Filling out the NY NYL ANN43042F is a straightforward process that can be completed online. This guide provides detailed instructions to help users navigate each section of the form with confidence.

Follow the steps to complete your NY NYL ANN43042F online.

- Press the ‘Get Form’ button to access the form and launch it in your online editor.

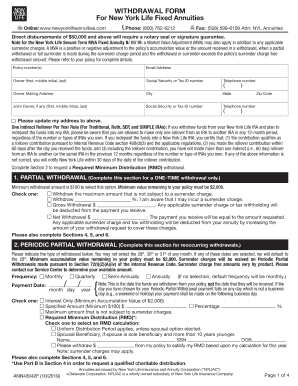

- Begin by entering your policy number(s) in the designated field. This number is essential for identifying your annuity account quickly.

- Provide your email address to facilitate communication regarding your request.

- Fill out your personal information, including your full name (first, middle initial, and last), Social Security or Tax ID number, telephone number, and mailing address. Ensure that the address is accurate as it may affect future correspondence.

- If applicable, enter information for a joint owner, including their name and Social Security or Tax ID number, and contact details.

- Indicate whether you would like to update your address by checking the corresponding box.

- Select your desired withdrawal method: partial, periodic, or full surrender. For partial withdrawals, indicate the amount and whether it’s a gross, net, or maximum withdrawal.

- For periodic withdrawals, specify the frequency and the desired date for the withdrawals. Ensure that the selected date is a business day.

- Complete the method of payment section by providing your financial institution's details, including account type, account holder’s names, routing number, and account number.

- Review the important tax information. You may need to choose whether or not to withhold taxes and indicate the percentages if applicable.

- Certify your taxpayer identification number, confirming your status as a U.S. person, and check any relevant boxes related to backup withholding.

- Sign the form in the designated area, ensuring to date it and include a notarized signature if required for amounts of $50,000 or more.

- Submit your completed form by following the instructions for mailing or faxing it to the NYL Annuity Service Center.

Complete your NY NYL ANN43042F form online today and ensure your annuity withdrawals are processed smoothly!

If you earn income from New York sources while living elsewhere, you generally must file a NY nonresident return. This requirement applies even if you only have a part-time job or investment income from the state. Navigating tax situations can be simple with the assistance of platforms like NY NYL ANN43042F, ensuring that you meet all obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.