Loading

Get Metlife Rmd Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MetLife Rmd Form online

Filling out the MetLife Required Minimum Distribution (RMD) Form online can be straightforward if you follow the steps outlined in this guide. This document is essential for individuals managing their retirement accounts and ensures compliance with IRS requirements.

Follow the steps to complete the MetLife Rmd Form online.

- Press the 'Get Form' button to access the form and open it in an appropriate editor.

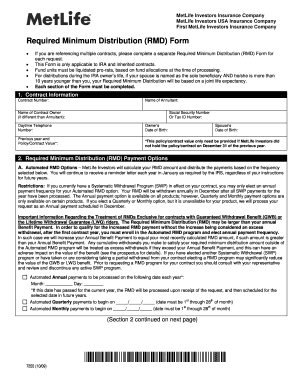

- Begin by completing the Contract Information section. Fill in your contract number, name of annuitant, and, if different, the name of the contract owner. Provide a daytime telephone number, the previous year-end policy/contract value, Social Security number or tax ID number, and the dates of birth for both yourself and your spouse.

- Proceed to the Required Minimum Distribution (RMD) Payment Options section. Select 'Automated RMD Options' or 'One-time RMD Options,' depending on your needs. If you choose automated options, specify the date for annual, quarterly, or monthly payments as applicable. If opting for one-time payments, choose whether you want your RMD calculated or to withdraw a specific amount.

- In the Income Tax Withholding Election section, decide whether to have federal and state income tax withheld from your RMD. Fill in the percentages accordingly, noting that failure to make an election will result in a default withholding of 10 percent for federal tax.

- Complete the Alternate Payment Instructions section, providing your account number and selecting a payment method, either check or electronic funds transfer. If selecting electronic transfer, attach a voided check and provide the alternate payee's information along with required banking details.

- Finally, in the Signature section, certify the information provided is correct by signing and dating the form. If signing on behalf of another individual or entity, indicate your title or position and include any required documentation.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form as necessary.

Complete your required minimum distribution process by filling out the MetLife Rmd Form online today.

The SECURE Act of 2019 changed the age at which RMDs begin from 70½ to 72. Secure 2.0 increases the age at which RMDs begin to age 73 for those individuals who turn 72 on or after January 1, 2023. Notably, an individual who attains age 72 in 2023 is not required to take an RMD for 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.