Loading

Get Ok Orec Seller Financing 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OREC Seller Financing online

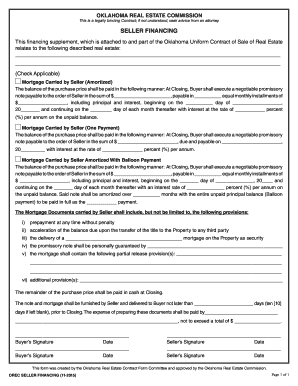

Filling out the Oklahoma Real Estate Commission Seller Financing form is essential for parties involved in real estate transactions. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the OK OREC Seller Financing form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the real estate that is being financed. In the designated area, provide the detailed description of the property as outlined in the Oklahoma Uniform Contract of Sale of Real Estate.

- Select the applicable financing type by checking the appropriate box: 'Mortgage Carried by Seller (Amortized)', 'Mortgage Carried by Seller (One Payment)', or 'Mortgage Carried by Seller Amortized With Balloon Payment'.

- Complete the necessary fields for the financing type selected. This includes the total amount of the promissory note, the number of monthly installments, payment amount, starting date, and interest rate.

- If applicable, fill in details regarding the required mortgage provisions such as prepayment rights, acceleration clauses, and additional security provisions.

- Indicate how the remaining balance of the purchase price will be paid at closing and any related expenses for document preparation.

- Ensure all relevant parties sign the form: both buyers and sellers must provide their signatures and dates in the appropriate sections.

- Review the completed form for accuracy before finalizing. Once you are satisfied, you can save your changes, download a copy, print it, or share the form as needed.

Complete your OK OREC Seller Financing form online efficiently today.

When discussing OK OREC Seller Financing with a seller, clarify how it benefits both parties. Explain that seller financing allows for easier negotiation on terms and can lead to quicker sales. Highlight that sellers can receive steady income while also having more control over the sale process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.