Loading

Get Nz Ird Ir633 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IRD IR633 online

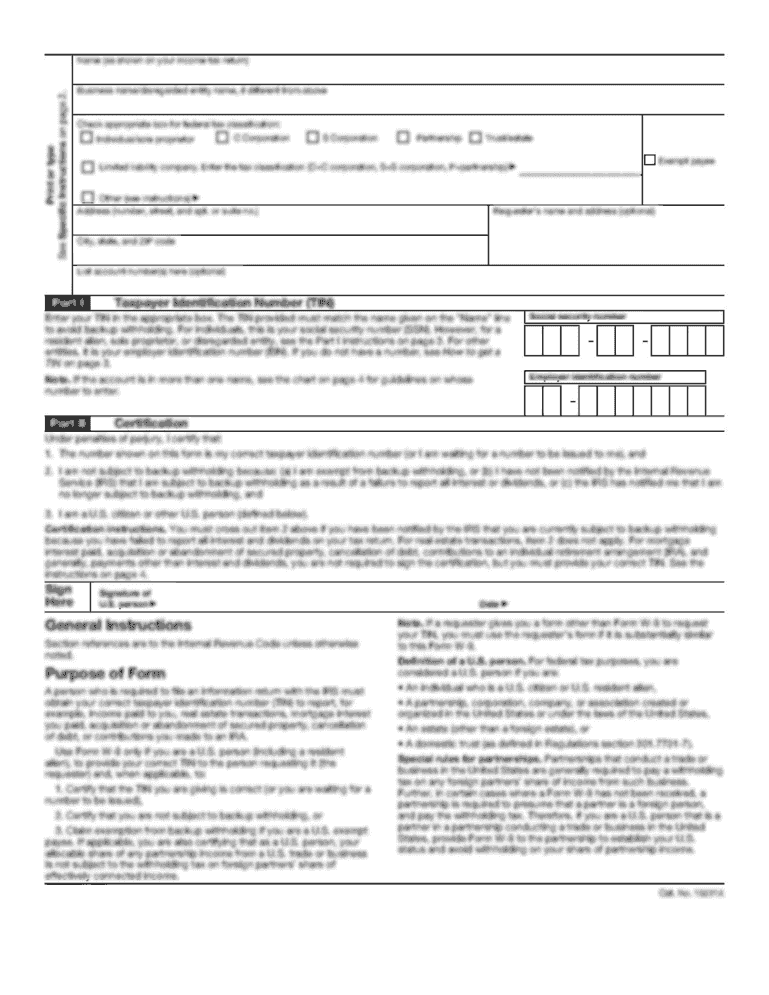

The NZ IRD IR633 form is essential for trusts that do not need to file an income tax return, designating them as non-active complying trusts. This guide will provide you with clear, step-by-step instructions on how to fill out this form online to ensure accurate submission.

Follow the steps to complete the NZ IRD IR633 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the trust name in the designated field at the top of the form. Ensure that the name matches what is registered with the Inland Revenue.

- Provide the postal address of the trust in the appropriate section. This address will be used for correspondence regarding the trust.

- Input the IRD number, ensuring it contains eight digits and begins in the second box.

- Indicate the balance date by filling out the day, month, and year fields as they relate to the trust's tax year.

- In the next section, confirm that the trust meets the specified non-active criteria. This includes checking boxes for not deriving gross income, having no deductions, and not being involved in transactions that generate income.

- Fill in the name of the authorized person completing the form. This person must be a recognized representative of the trust.

- Enter the designation or title of the authorized person, along with their email address and phone number.

- Provide a date for the completion of the form by entering the day, month, and year.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your NZ IRD IR633 online to ensure your trust remains compliant.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

While it is possible to open a bank account in New Zealand without an IRD number, it may complicate the process. Certain banks might impose additional requirements or restrictions if you lack an NZ IRD number. Consider obtaining your NZ IRD IR633 to enhance your banking experience and ensure compliance with local regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.