Loading

Get Wi I-017i 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI I-017i online

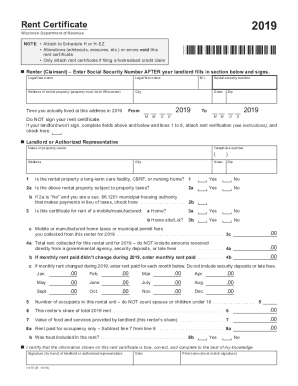

The WI I-017i is a critical document for renters seeking to claim a homestead credit through the Wisconsin Department of Revenue. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently, ensuring all requirements are met.

Follow the steps to complete the WI I-017i online.

- Click 'Get Form' button to obtain the WI I-017i form and open it in your preferred editor.

- In the 'Renter (Claimant)' section, enter your legal last name, first name, and address of the rental property. Ensure that the rental property is located in Wisconsin.

- Fill in the social security number after your landlord has completed and signed the relevant sections.

- Indicate the time period you actually lived at the address in 2019 by entering the 'From' and 'To' dates.

- Move to the section for your landlord or authorized representative. Fill in their name, telephone number, and address.

- Answer the questions regarding the rental property, including whether it is a long-term care facility and if it is subject to property taxes.

- Complete the rental amounts, including total rent collected for 2019, excluding any amounts from governmental agencies, security deposits, or late fees.

- Input the number of occupants inhabiting the rental unit, excluding children under 18 and your spouse.

- Provide the value of food and services offered by the landlord; this will be useful for further calculations.

- Sign the certificate only if you are the landlord or their authorized representative; the renter must not sign.

- At the end of the process, ensure you save your form, download, print or share it as necessary.

Complete your documents online to ensure you meet all filing requirements smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, Wisconsin offers a homestead exemption specifically designed for seniors. This program allows older citizens to receive property tax relief based on their income and property value. To qualify, seniors must meet age and residency requirements alongside income limits. For detailed guidance on securing this exemption and understanding the provisions of WI I-017i, explore uslegalforms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.