Loading

Get Stanford University Securities Transfer Request Form 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Stanford University Securities Transfer Request Form online

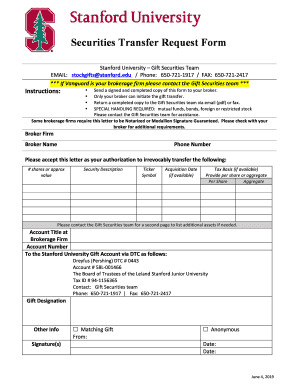

Completing the Stanford University Securities Transfer Request Form online is an essential step in facilitating the transfer of securities as a gift to the university. This guide provides clear, step-by-step instructions to help users navigate the form efficiently.

Follow the steps to complete the transfer request form with ease.

- Press the 'Get Form' button to access the Securities Transfer Request Form and open it in your digital editor.

- Begin by filling in the 'Broker Firm' section with the name of your brokerage firm. Ensure accuracy to prevent any processing delays.

- Next, provide the 'Broker Name' and 'Phone Number' for your brokerage. This information is crucial for communication regarding the transfer.

- In the authorization section, detail the number of shares to be transferred alongside the approximate value of the securities you wish to donate.

- Include the 'Security Description' along with the 'Ticker Symbol' of the securities being transferred. Accurate descriptions aid in proper identification of the assets.

- If available, provide the 'Acquisition Date' and 'Tax Basis.' You can choose to enter this information 'Per Share' or as an 'Aggregate' total.

- If additional assets need to be listed, refer to the Gift Securities team for a second page to complete this information accurately.

- Fill in the 'Account Title' at your brokerage along with your 'Account Number' to ensure the correct identification of your account.

- Specify the details of the transfer to the Stanford University Gift Account via DTC by confirming the Dreyfus (Pershing) DTC number and account information provided in the form.

- Choose the 'Gift Designation' that applies to your donation, including options for matching gifts or remaining anonymous.

- Lastly, sign and date the form. It's important that your signature is provided as this signifies your authorization for the transfer.

- After completing the form, save your changes, and you can choose to download, print, or share the completed request as necessary.

Complete and submit your Securities Transfer Request Form online to support Stanford University today.

Yes, Stanford University is considered a charitable organization, dedicated to advancing education, research, and public service. This commitment allows it to accept tax-deductible donations from supporters. Using the Stanford University Securities Transfer Request Form can help you make your charitable contribution in an efficient manner, contributing to its mission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.