Loading

Get Nz Gst101a 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ GST101A online

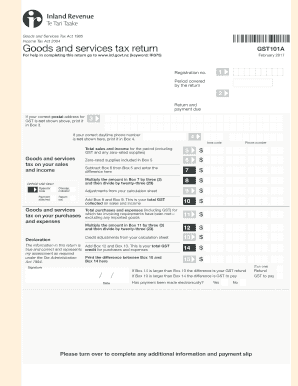

Filling out the NZ GST101A is essential for managing your goods and services tax obligations effectively. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the NZ GST101A online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Box 1, enter your registration number as shown on your GST certificate.

- In Box 2, specify the period covered by this return. Make sure to use the correct start and end dates.

- If your correct postal address for GST is not shown above, print it in Box 3 for accurate correspondence.

- Provide your accurate daytime phone number in Box 4 to ensure you can be reached if needed.

- In Box 5, enter the total sales and income for the period, including GST and any zero-rated supplies.

- List any zero-rated supplies included in Box 5 in Box 6.

- Subtract the amount in Box 6 from the total in Box 5 and enter the difference in Box 7.

- Multiply the amount in Box 7 by three (3) and divide by twenty-three (23); enter the result in Box 8.

- List any adjustments from your calculation sheet in Box 9.

- Add the values in Box 8 and Box 9 to calculate the total GST collected on sales and income; enter this in Box 10.

- In Box 11, input the total purchases and expenses for which tax invoicing requirements have been met, excluding imported goods.

- Multiply the amount in Box 11 by three (3) and divide by twenty-three (23); record this value in Box 12.

- Input any credit adjustments from your calculation sheet in Box 13.

- Add Box 12 and Box 13 to get the total GST credit for purchases and expenses; enter this in Box 14.

- Calculate the difference between Box 10 and Box 14 and print it in Box 15, noting if it is a GST refund or GST to pay.

- Indicate whether payment has been made electronically in the relevant section.

- Complete the additional information and payment slip located on the reverse side of the form.

- After reviewing all entries for accuracy, save your changes, download, print, or share the form as necessary.

Start filling out your NZ GST101A online today to stay compliant with your GST obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

No, GST in New Zealand is currently set at 15%, and it has not been 12.5% since the increase in 2010. Being aware of the current rate is essential for anyone conducting business in New Zealand. Keep informed with NZ GST101A to ensure compliance with tax regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.