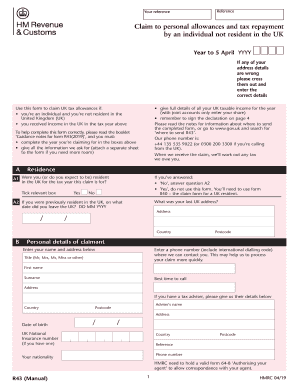

Get Uk Hmrc R43 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC R43 online

How to fill out and sign UK HMRC R43 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Taxes, regulatory, corporate, and other documentation necessitate a high level of safeguarding and adherence to the law. Our templates are frequently refreshed in line with the most recent legislative updates.

Moreover, with us, all the information you supply in the UK HMRC R43 is shielded from leaks or damage through superior encryption.

Our service allows you to manage the entire process of submitting legal documents online. As a result, you save time (potentially hours, days, or even weeks) and eliminate unnecessary costs. Henceforth, complete the UK HMRC R43 from the comfort of your home, your workplace, or even while on the move.

- Access the form in our comprehensive online editing tool by clicking Get form.

- Complete the required fields highlighted in yellow.

- Press the arrow labeled Next to navigate through each box.

- Utilize the e-signature tool to affix an electronic signature to the form.

- Insert the date.

- Review the entire e-document to ensure that you haven't overlooked any crucial details.

- Click Done and save the revised form.

How to Modify Get UK HMRC R43 2019: Personalize Forms Online

Experience a hassle-free and paperless method for adjusting Get UK HMRC R43 2019. Leverage our reliable online service and save considerable time.

Creating every document, including Get UK HMRC R43 2019, from the beginning requires excessive effort, hence utilizing a proven platform of pre-uploaded form templates can enhance your productivity remarkably.

Yet, altering them might pose a difficulty, particularly with documents in PDF format. Luckily, our extensive library features a built-in editor that allows you to conveniently complete and modify Get UK HMRC R43 2019 without departing from our site, ensuring you don’t waste your valuable time adjusting your documents. Here’s how to work with your form using our tools:

Whether you aim to execute modifiable Get UK HMRC R43 2019 or any other template within our library, you’re well-prepared with our online document editor. It’s straightforward and secure and doesn’t necessitate any specific expertise. Our browser-based tool is designed to accommodate virtually every aspect you might imagine regarding file editing and execution.

Move away from conventional methods of handling your forms. Opt for a professional solution that simplifies your tasks and reduces dependence on paper.

- Step 1. Locate the desired document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our professional editing features that permit you to add, delete, annotate, and highlight or obscure text.

- Step 4. Create and attach a legally-binding signature to your document by selecting the sign option from the upper toolbar.

- Step 5. If the document layout isn’t as you require, utilize the options on the right to delete, insert, and rearrange pages.

- Step 6. Add fillable fields so that other individuals can be invited to complete the document (if applicable).

- Step 7. Distribute or send the form, print it, or choose the format in which you’d prefer to save the document.

Get form

Related links form

A R43 is a tax form used by individuals in the UK to claim back tax that has been overpaid on specific sources of income, such as savings. By submitting the UK HMRC R43, taxpayers can provide detailed information about their income to HMRC. This form is essential for those looking to recoup extra taxes, making it a vital component of tax management.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.