Loading

Get Co Cr 0100 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO CR 0100 online

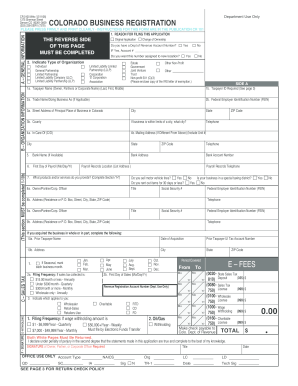

The CO CR 0100 form is essential for business registration in Colorado. This guide offers a straightforward walkthrough to help users successfully complete this form online, ensuring a smooth registration process.

Follow the steps to complete the CO CR 0100 online.

- Press the ‘Get Form’ button to access the CO CR 0100 form and open it in your browser's editor.

- Begin by providing the reason for filing this application in Section A. Select 'Original Application' and indicate if this number is assigned to a new location.

- In Section 1a, fill in the taxpayer name, including last, first, and middle names. This should be the owner, partners, or corporate name.

- Enter the taxpayer ID in Section 1b. This field is required and should match your identification.

- If applicable, provide your trade name or doing business as (DBA) in Section 2a.

- Complete Section 2b with your Federal Employer Identification Number (FEIN). This is important for tax purposes.

- In Section 3a, indicate your principal place of business in Colorado by providing the complete street address. Include city and state.

- Fill out Section 3b with the county where your business operates. If within city limits, specify the city.

- Provide your contact telephone number in the designated field.

- If applicable, complete Section 4a by adding an 'In Care Of' name, and Section 4b with a mailing address if it's different from the principal address.

- In Section 7, describe the products and/or services your business provides. This section may require further detail, especially if you sell specific items or offer certain services.

- Make sure all relevant sections on the reverse side are completed, including inquiries related to ownership changes and relevant tax information.

- Sign the form in Section F, ensuring that the signature is from the owner, partner, or corporate officer as required.

- After filling out all required fields, review your entries, and save your changes. You can also download, print, or share your completed form as necessary.

Complete your CO CR 0100 form online today to streamline your business registration process.

Related links form

Getting a Colorado withholding account number involves registering with the Colorado Department of Revenue online. You can complete the registration process by providing necessary business information, including your federal Employer Identification Number (EIN). Platforms like US Legal can help guide you through the registration process, ensuring you have all needed documentation on hand to secure your CO CR 0100 account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.