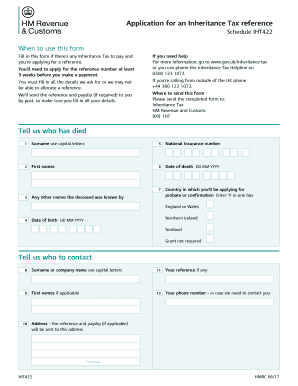

Get Uk Hmrc Iht422 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC IHT422 online

How to fill out and sign UK HMRC IHT422 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Selecting a certified specialist, scheduling an appointment, and visiting the office for a personal meeting renders completing a UK HMRC IHT422 from start to finish exhausting.

US Legal Forms allows you to quickly generate legally valid documents using pre-made online templates.

Quickly create a UK HMRC IHT422 without needing to consult professionals. We already have over 3 million customers benefiting from our extensive collection of legal forms. Join us today and gain access to the top online library of templates. Experience it yourself!

- Obtain the UK HMRC IHT422 you require.

- Access it using the cloud-based editor and begin modifying.

- Complete the empty fields; involved parties' names, addresses, and contact numbers, etc.

- Replace the blanks with specific fillable fields.

- Insert the date/time and affix your e-signature.

- Click on Done after double-checking everything.

- Store the finished documents to your device or print it out as a physical copy.

How to Modify Get UK HMRC IHT422 2017: Personalize Forms Online

Explore a singular service to manage all of your documentation effortlessly. Locate, modify, and complete your Get UK HMRC IHT422 2017 within one interface with the assistance of intelligent tools.

The days of printing forms or manually writing them are over. Nowadays, all you need to do to find and complete any form, like the Get UK HMRC IHT422 2017, is to open a single browser tab. Here, you will discover the Get UK HMRC IHT422 2017 form and modify it in any way you require, from typing directly in the document to drawing on a digital sticky note and attaching it to the document. Uncover tools that will simplify your paperwork with minimal effort.

Click the Get form button to swiftly prepare your Get UK HMRC IHT422 2017 documentation and begin editing it right away. In the editing mode, you can effortlessly populate the template with your details for submission. Just click on the field you wish to alter and input the data immediately. The editor's interface does not necessitate any specialized skills for usage. Once you have completed the edits, verify the information's accuracy once more and sign the document. Click on the signature field and follow the directions to eSign the form in no time.

Utilize More tools to personalize your form:

Preparing Get UK HMRC IHT422 2017 forms will never be perplexing again if you know where to find the appropriate template and prepare it swiftly. Do not hesitate to give it a try.

- Employ Cross, Check, or Circle tools to indicate the document's details.

- Insert text or fillable text fields using text customization tools.

- Remove, Highlight, or Blackout text sections in the document with the appropriate tools.

- Add a date, initials, or even an image to the document if necessary.

- Utilize the Sticky note tool for form annotations.

- Make use of the Arrow and Line, or Draw tool to append visual elements to your file.

In the UK, you can inherit up to a certain threshold without paying inheritance tax. The current threshold, or nil-rate band, is £325,000 per person. If your estate is below this limit, you typically won’t owe tax. Be sure to check the latest details, as these can change, especially in reference to guidelines like the UK HMRC IHT422.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.