Get Uk Hmrc Cisc2 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC CISC2 online

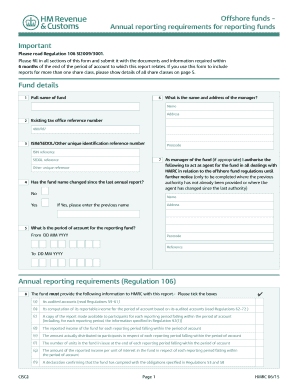

Filling out the UK HMRC CISC2 form is essential for meeting annual reporting requirements related to offshore funds. This guide will provide clear, step-by-step instructions to help ensure that users complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to obtain the document and access it for editing.

- Begin by entering the full name of the fund in the designated field. This identifies the fund for which the report is being submitted.

- Provide the existing tax office reference number, which is important for HMRC identification.

- Include the ISIN, SEDOL, or other unique identification reference number as required to uniquely identify the fund.

- Indicate if the fund name has changed since the last annual report by selecting 'Yes' or 'No.' If 'Yes,' please enter the previous name.

- Enter the manager's name and address in the relevant fields, ensuring that this information is current.

- Specify the period of account for the reporting fund by entering the start and end dates in the format DD MM YYYY.

- In the annual reporting requirements section, tick the boxes for all documents that you are submitting, such as audited accounts and computations of reportable income.

- Respond to questions regarding the fund’s accounts, including whether they have been prepared in line with International Accounting Standards.

- Complete sections related to income adjustments and equalisation, providing necessary explanations on a separate sheet if applicable.

- Review the declaration section to affirm that the fund has complied with all obligations specified by HMRC.

- Sign and date the form in the declaration section, confirming your capacity in which you are signing.

- Finally, ensure that all necessary attachments are included and send the completed report to HMRC's Collective Investment Schemes Centre.

Complete your HMRC CISC2 form online today to ensure compliance with reporting requirements.

Related links form

Non-reporting funds typically face a different tax regime in the UK than reporting funds. While the gains from these funds may not be reported to HMRC yearly, they can be taxed when the investor disposes of their interest. It’s critical to be aware of these regulations to avoid unexpected tax liabilities associated with non-reporting funds under the UK HMRC CISC2 framework. Consulting specialized resources can assist in managing these complexities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.