Loading

Get Ca Form 3805e 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3805E online

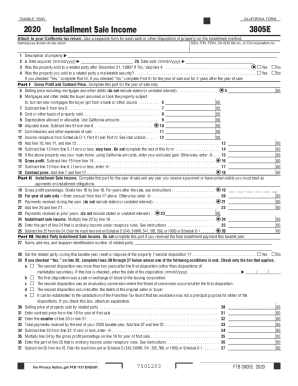

This guide provides clear and comprehensive instructions for completing the CA Form 3805E, which pertains to installment sale income for California tax returns. Follow these steps to ensure that you fill out the form accurately and efficiently online.

Follow the steps to fill out the CA Form 3805E online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year in the designated field. In this case, make sure to indicate '2020' as your taxable year for the form.

- Fill in your name(s) exactly as they appear on your tax return. This ensures consistency and helps with identification when processing your form.

- Provide your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Federal Employer Identification Number (FEIN), California Secretary of State file number, or California corporation number in the respective fields.

- Describe the property you are reporting on the form. Be detailed to ensure clarity regarding the nature of the sale.

- Input the date you acquired the property in the format mm/dd/yyyy, followed by the date it was sold.

- Answer the related party question. If you sold the property to a related party after December 31, 1980, indicate 'Yes' or 'No' as applicable.

- Complete Part I, Gross Profit and Contract Price, by filling out lines 5 through 18 based on your selling price, mortgages, costs, and related expenses.

- Fill out Part II, Installment Sale Income, for the year of sale and any subsequent years you received payment. This includes calculating your gross profit percentage and entering received payments.

- If applicable, complete Part III, Related Party Installment Sale Income. This is only necessary if you have not received the final installment payment during the taxable year.

- After completing all relevant parts, review the form for accuracy and completeness.

- Save your changes and choose to download, print, or share the form as necessary for your records.

Complete your CA Form 3805E online today to streamline your tax reporting process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.