Get Bankruptcy B6a 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bankruptcy B6A online

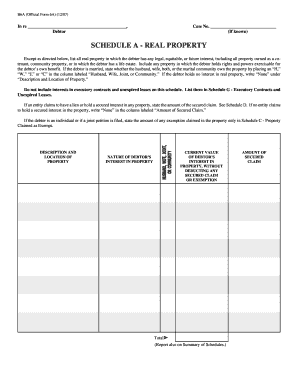

The Bankruptcy B6A form is an important document that details the real property interests of a debtor. This guide will provide a clear and supportive walkthrough on how to fill out this form online, ensuring that users understand each component thoroughly.

Follow the steps to complete the Bankruptcy B6A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the section labeled ‘In re,’ enter the full name of the debtor. Ensure that the name is spelled accurately to avoid complications in the filing process.

- Fill in the case number field if it is known. This helps to properly associate the form with the relevant bankruptcy case.

- In the ‘Schedule A - Real Property’ section, list all real property interests meticulously. Include the description and location of each property you own, marking any interest types such as cotenant or community property.

- If applicable, indicate the ownership type by placing an 'H' for husband, 'W' for wife, 'J' for joint, or 'C' for community in the designated column.

- For properties that do not apply, write ‘None’ in the ‘Description and Location of Property’ section.

- If any entities claim a lien or secured interest in the properties listed, provide the amount of the secured claim in the relevant column. If none exist, indicate ‘None’.

- Remember that exemption amounts related to the property should not be listed here but should be recorded in Schedule C.

- Once all necessary fields are completed, review the information for accuracy and completeness before proceeding.

- After finalizing the entries, you can save your changes, download a copy for your records, print the form, or share it as needed.

Complete your Bankruptcy B6A form online today to ensure a clear and accurate submission.

Related links form

To file for Bankruptcy B6A, there isn't a specific amount of debt required. However, individuals typically find it beneficial when their debts, such as credit cards and medical bills, grow unmanageable. If you have significant financial struggles and debts are affecting your quality of life, exploring Bankruptcy B6A might be a practical solution. It's essential to examine your situation carefully to determine if bankruptcy is the right choice for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.