Loading

Get Wi Dor W-ra 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR W-RA online

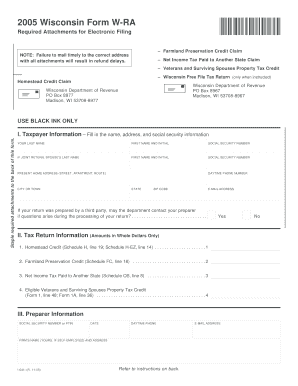

Filling out the WI DoR W-RA form online requires careful attention to detail to ensure all necessary information is provided. This comprehensive guide will walk you through each section of the form, helping you successfully submit required attachments for your electronic filing.

Follow the steps to accurately complete the WI DoR W-RA form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the Taxpayer Information section, enter the required personal details, including your last name, first name and initial, and social security number. If you are filing jointly, include your spouse's last name, first name and initial, and social security number as well.

- Fill in your current home address, ensuring to include the street, apartment or route, city or town, state, and zip code. Also, provide your daytime phone number and email address if applicable.

- Indicate whether the Department of Revenue may contact your tax preparer if any questions arise. Choose 'Yes' or 'No'.

- Move to the Tax Return Information section. Here, enter the amounts for the Homestead Credit, Farmland Preservation Credit, Net Income Tax Paid to Another State, and Eligible Veterans and Surviving Spouses Property Tax Credit as specified in the accompanying schedules.

- Proceed to the Preparer Information section. If a third party prepared your return, provide their social security number or PTIN along with the date, daytime phone number, firm’s name and address, and email address.

- Review all your entries for accuracy and completeness before saving your form.

- Once confirmed, save your changes, and utilize the options available to download or print the form. Be prepared to mail the original form along with the necessary attachments to the specified address as indicated in the form instructions.

Complete your documents online confidently and ensure accurate submissions for timely refunds.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, a non-resident is required to file an income tax return if they have earned income in Wisconsin. This is important for staying compliant with state tax laws. The WI DoR W-RA form will guide you through the filing process, making it easier to fulfill your requirements and avoid penalties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.