Loading

Get Uk Hmrc Ch2 (cs) 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC CH2 (CS) online

Filling out the UK HMRC CH2 (CS) form online is essential for claiming Child Benefit for additional children. This guide provides a step-by-step approach to help you navigate the key sections of the form with ease.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the CH2 (CS) form and open it for completion.

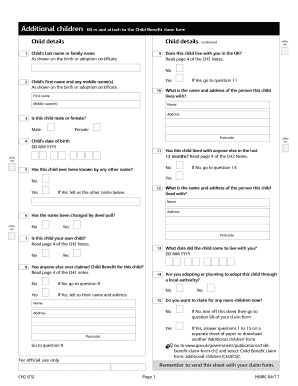

- In the 'Child details' section, enter the child's last name as it's shown on the birth or adoption certificate in the appropriate field.

- Next, input the child's first name and any middle names in the designated fields. Ensure you match the names on the birth or adoption certificate accurately.

- Indicate whether the child lives with you in the UK by selecting 'Yes' or 'No.' If 'Yes,' continue to the next question.

- Specify whether the child is male or female by selecting the corresponding option.

- Provide the child's date of birth using the format DD MM YYYY.

- If the child has ever been known by any other name, select 'Yes' and provide the previous name. If 'No,' proceed to the next question.

- Answer if the child has lived with anyone else in the past 12 months. If 'Yes,' include the name and address of that person.

- State whether the child's name has been changed by deed poll by selecting 'Yes' or 'No.'

- Confirm if the child is your own by selecting the appropriate option as per the guidelines provided on page 4 of the CH2 Notes.

- If you are adopting or planning to adopt this child, select 'Yes' and provide the necessary details, if applicable.

- Answer whether anyone else has claimed Child Benefit for this child by selecting 'Yes' or 'No.' If 'Yes,' provide the name and address of that person.

- Consider if you wish to claim for any more children now. If you want to claim for additional children, complete the specified steps for each. If you're finished, proceed to tear off the additional sheet and go to question 68 of your claim form.

Complete your Child Benefit claim online today for a hassle-free experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

CH2 notes refer to guidance provided alongside the Child Benefit claim process. These notes explain how to complete the CH2 form, what information you need to provide, and the eligibility criteria for receiving Child Benefit. Utilizing CH2 notes can clarify the application process and ensure you do it correctly, maximizing your chances of success.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.