Get Uk Hmrc Eis1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC EIS1 online

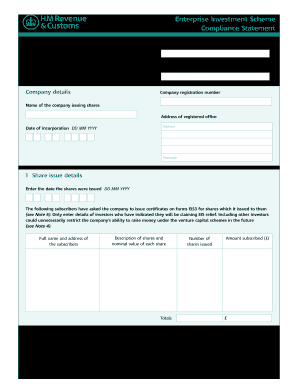

The UK HMRC EIS1 form is essential for companies seeking investment under the Enterprise Investment Scheme. This guide provides a step-by-step approach to effectively navigate and complete the form online, ensuring compliance with the necessary requirements.

Follow the steps to fill out the UK HMRC EIS1 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'To' section, ensure you enter your reference number accurately. This helps HM Revenue & Customs identify your submission promptly.

- Next, fill in the company details section, including the company registration number, name, address of the registered office, and the date of incorporation.

- For the 'Share issue details,' enter the date the shares were issued and provide details of subscribers who will be claiming EIS relief. Only include relevant investors to avoid restrictions on future fundraising.

- In the 'Qualifying business activity' section, explain how the funds raised will be used. Specify if the funds are for trade or research and development.

- Continue by detailing any changes to the company's issued share capital and loan capital since the share issue.

- Complete the declaration section, ensuring all statements are true and the requisite conditions are understood and met.

- Finally, review your entries for accuracy. You can then save changes, download, print, or share the completed form.

Complete your EIS1 form online today to ensure timely submission and compliance with HMRC regulations.

Get form

To qualify for EIS, companies must meet specific criteria set by HMRC, including being a UK company and having fewer than 250 employees at the time of investment. It’s important to ensure that the business has raised no more than £5 million in the last 12 months and that it is not listed on a stock exchange. Investors should also confirm their eligibility under the UK HMRC EIS1 guidelines to benefit from tax relief. Consulting resources on platforms like uslegalforms can provide valuable insights into this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.