Loading

Get India Vat-103

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India VAT-103 online

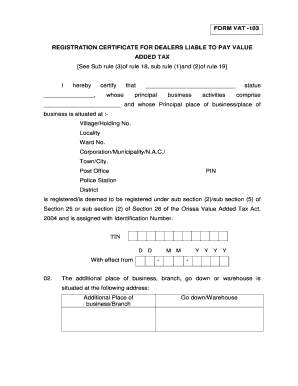

Filling out the India VAT-103 form is essential for dealers liable to pay value-added tax. This guide offers step-by-step instructions to help you efficiently complete the form online.

Follow the steps to complete the VAT-103 form online.

- Click ‘Get Form’ button to obtain the VAT-103 form and open it in the editor.

- Begin by providing your certification details. Enter the name of the dealer along with their principal business activities in the designated fields.

- Fill in the principal place of business address. Include details such as the village or holding number, locality, ward number, and city. Don’t forget to input the post office, PIN, police station, and district.

- Indicate the registration status of the dealer. Specify whether the dealer is registered under specific subsections of the Orissa Value Added Tax Act, and mention the Tax Identification Number (TIN).

- Record the effective date of registration in the format DD/MM/YYYY.

- List the additional places of business, branch, go downs, or warehouses. Provide the addresses in the respective fields.

- Detail the goods purchased or intended to be purchased other than for resale. Fill in the description of each item or class of goods.

- Specify any goods purchased as capital goods, raw materials, consumables, fuels directly involved in manufacturing, or packing materials.

- Identify bye-products manufactured or produced for sale. Describe each bye-product and indicate if it is taxable or tax-free.

- Complete the section regarding goods purchased for use in works contracts. Provide descriptions of each item.

- Finalize your form by entering the date and location at the end, and ensure you include the necessary seal from the registering authority.

- Before submission, review the form for completeness. Ensure all applicable fields are filled, and no boxes are left blank or improperly marked.

- Once the form is complete, you can save changes, download, print, or share the form as needed.

Complete your VAT-103 form online today to ensure compliance with tax regulations.

The format of VAT in India generally includes your VAT registration number, details of sales and purchases, and the applicable tax rates. Each state may have slight variations, so it's essential to check specific state guidelines. Utilizing resources like the India VAT-103 helps ensure you maintain the correct format for compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.