Loading

Get India Form 39

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Form 39 online

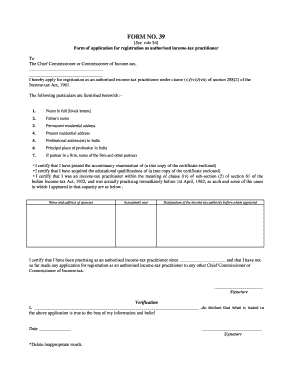

Completing the India Form 39 is an essential step for those seeking registration as an authorized income-tax practitioner. This guide provides clear, step-by-step instructions to help users navigate the online filling process efficiently.

Follow the steps to successfully complete India Form 39 online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering your full name using block letters in the designated field.

- Provide your father's name in the appropriate section.

- Fill in your permanent residential address accurately.

- Input your current residential address, if different from your permanent address.

- List your professional address or addresses in India in the specified field.

- Indicate your principal place of profession in India in the relevant box.

- If you are a partner in a firm, name the firm and the other partners associated with it.

- Certify that you have passed the required accountancy examination by attaching a true copy of the certificate.

- Confirm that you have the necessary educational qualifications by attaching a true copy of that certificate as well.

- Declare your previous practice as an income-tax practitioner, including relevant details about your practice that was ongoing before 1st April, 1962.

- Provide the names and addresses of the assessees, the assessment year, and the designation of the income-tax authority before whom you appeared.

- Affirm your continuous practice as an authorized income-tax practitioner by entering the commencement date.

- Sign the application at the designated space.

- Complete the verification section by stating your name and confirming that all information is true to the best of your knowledge.

- Enter the date of verification in the provided field.

- Finally, review all entered information for accuracy. Save changes, download the completed form, print, or share it as necessary.

Begin filing your documents online today to ensure your timely application.

Form 10F is necessary for non-residents claiming tax benefits under the double taxation avoidance agreement. While not every taxpayer needs to file it, those who have income sourced in India must be aware of its importance. Ensuring compliance with documents like Form 10F exemplifies good tax practices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.