Loading

Get Ie Sarp Employer Return 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE SARP Employer Return online

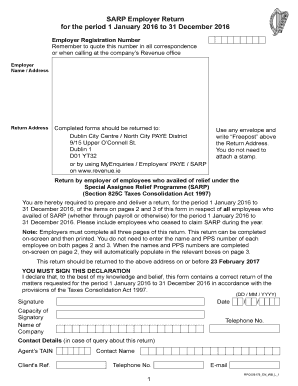

Filling out the IE SARP Employer Return is a crucial process for employers who have employees benefiting from the Special Assignee Relief Programme. This guide will provide you with clear, step-by-step instructions to help you navigate the completion of this online form efficiently.

Follow the steps to complete your return with ease

- Press the ‘Get Form’ button to obtain the IE SARP Employer Return and open it for editing.

- Enter your Employer Registration Number at the top of the form. This number is essential and should be included in all future correspondence related to the return.

- Fill out your name and address in the Employer section. Ensure that this information is accurate and matches corresponding records.

- Complete the Return Address section with the designated address to which the form should be submitted. Remember to include 'Freepost' above your address if using an envelope.

- Provide details for each employee who availed of SARP relief. For each employee, enter their name, PPS number, nationality, and the country where they worked before arriving in the state.

- Include the job title and a brief description of each employee's role while utilizing SARP relief.

- Record the gross income from the employment for each employee before the deduction of SARP relief, detailing any pension contributions and non-taxable amounts.

- Document any associated costs for school fees for children, along with the amount of SARP relief claimed, if applicable. Make sure to enter 'N/A' if the relief was not claimed through payroll.

- Indicate any school fees reimbursed by you for children attending an approved school in the state.

- Complete the required fields regarding the increase in the number of employees and those retained as a result of SARP relief operation. This information is vital for the annual report.

- Sign the form, including the date, capacity of the signatory, and the name of the company. Ensure that the signature is completed to validate the return.

- Once all fields are completed, save your changes, download the completed form, or print it for submission.

- Return the completed form by mail or through the designated online enquiry service, ensuring it is submitted by the required deadline.

Complete your IE SARP Employer Return online today to ensure compliance and avoid delays.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To complete an employee withholding tax exemption certificate, employers need to gather relevant personal information and financial details. This ensures that the correct exemptions are applied to the employee's paycheck. For a smooth process related to the IE SARP Employer Return, using legal forms from USLegalForms can provide assurance and accuracy.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.