Loading

Get Ie Icc 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE ICC 2 online

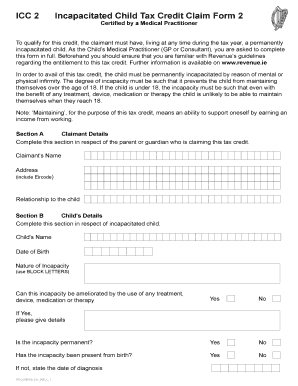

Filling out the IE ICC 2 form is essential for claiming the Incapacitated Child Tax Credit. This guide will walk you through the process step-by-step to ensure you complete the form accurately and efficiently.

Follow the steps to successfully fill out the IE ICC 2 form.

- Click ‘Get Form’ button to access the form and open it in a suitable editor.

- In Section A, provide the claimant details. Enter the full name of the parent or guardian who is applying for the credit, their complete address (including Eircode), and their relationship to the incapacitated child.

- Move to Section B to fill in the child's details. Start with the child's name and date of birth, ensuring you use the correct format (DD/MM/YYYY). Then, describe the nature of the child's incapacity in BLOCK LETTERS.

- Respond to questions regarding the incapacity: clarify if it can be improved through treatment or therapy, confirm whether it is permanent, and indicate if it has been present since birth. If applicable, provide the date of diagnosis.

- Proceed to Section C, the declaration area. Sign the form acknowledging you have read the relevant guidelines. Indicate if the child is under 18 or over 18 and affirm the details you have provided are accurate.

- Include your medical registration number, print your name, and enter the date of signing, email, and phone number for contact purposes.

- Once the form is complete, save your changes, and whether needed, download, print, or share the form as required.

Start completing your IE ICC 2 form online now for a smoother claim process.

In Ireland, tax credits available for widows include various relief options designed to provide financial support during a difficult transition. These credits help in easing the tax burden and can vary based on individual circumstances. Completing the IE ICC 2 form accurately ensures that widows receive the appropriate benefits tailored to their needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.